The price of Bitcoin collapsed this week amid ongoing tensions over the bond market and the relatively hawkish Federal Reserve.

Bitcoin (Bitcoin) to below $95,000, triggering a sharper sell-off among altcoins. However, there are signs that the coin may bounce back and possibly reach $122,000 in January.

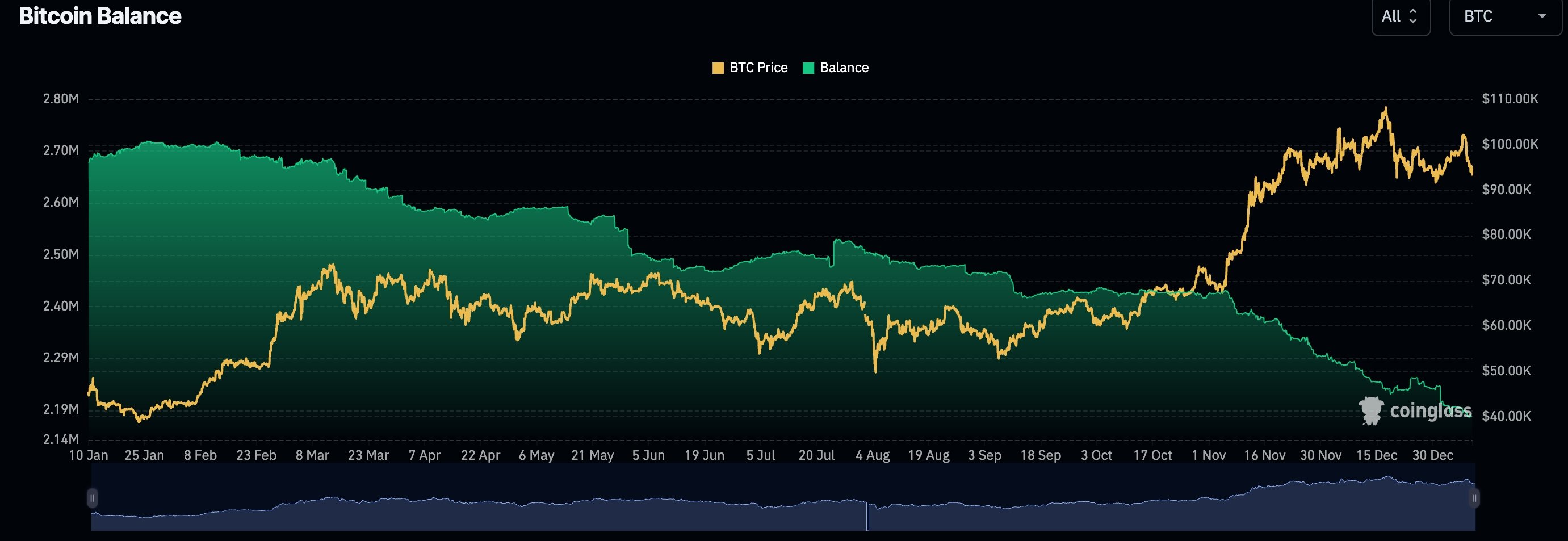

Bitcoin balances on exchanges are declining

One of the main reasons why BTC price may rebound in January is the ongoing imbalance between demand and supply. Demand has continued to rise this year, as evidenced by the growth ETF flows.

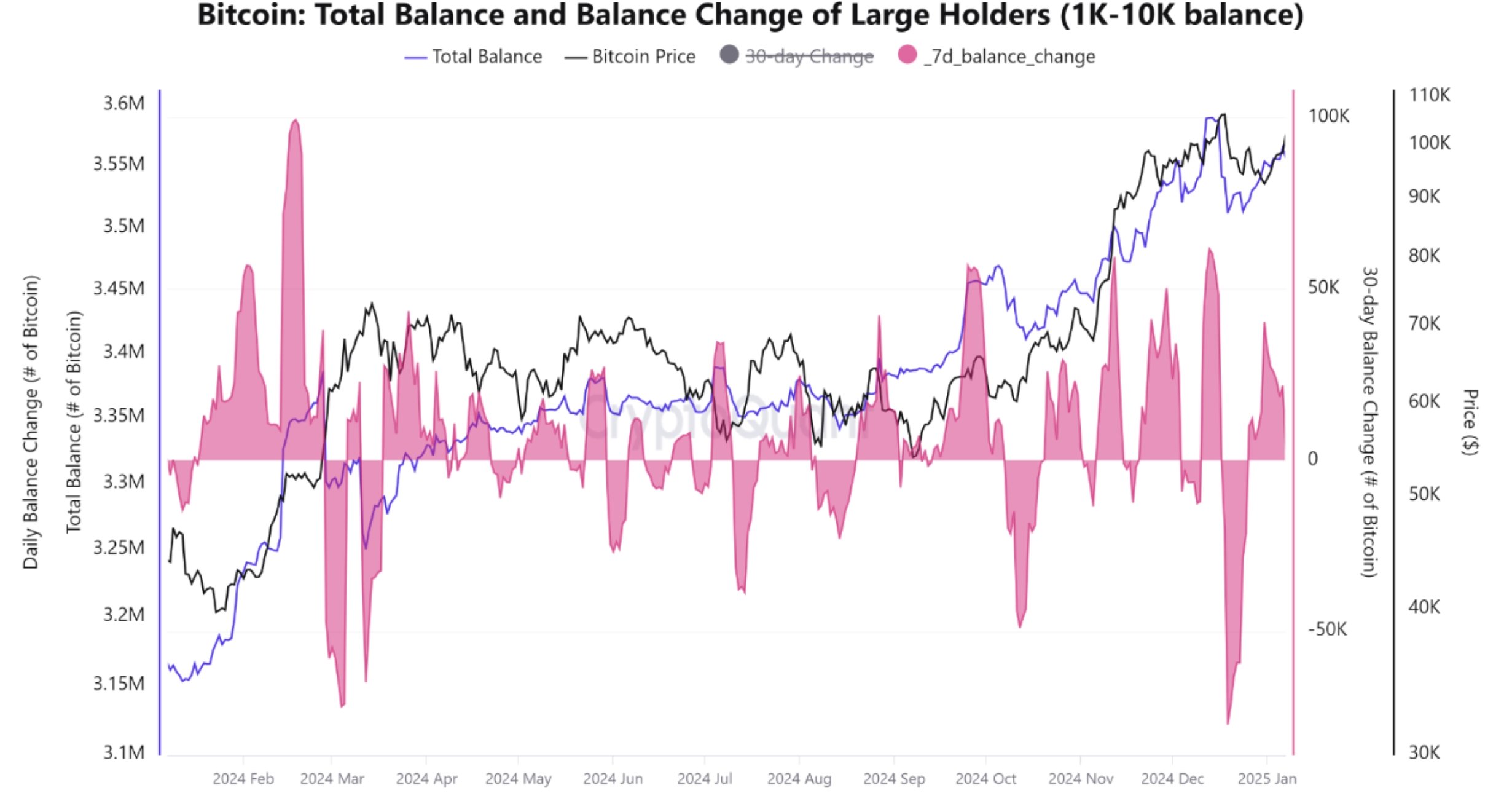

Spot bitcoin ETFs have added $1.3 billion in net assets this year, while companies like MicroStrategy have continued to rise. Bitcoin whales also continued to do so AccumulateAdding 34,000 coins since December.

Supply is also shrinking, as seen in Bitcoin balances on exchanges. According to CoinGlass, the number of BTC held on exchanges has fallen to its lowest level in years. Balances now stand at 2.1 million, down from 2.72 million in January 2024. So, this imbalance between demand and supply could soon benefit Bitcoin.

FTX Dividends and Donald Trump's Inauguration

Another major catalyst for Bitcoin prices is the upcoming $16 billion distribution from FTX Estate to investors and creditors. Most of this money is currently held in stablecoins such as Tether (USDT) and the US dollar currency (US dollars). While some recipients will convert it into cash, some of the money will be converted into cryptocurrencies like Bitcoin.

Additionally, Donald Trump will be sworn in on January 20, ushering in a new era of cryptocurrency regulations. Although much of this has already been priced in, there is a possibility that Bitcoin and other altcoins could rise before the event and Gary Gensler resignation.

Bitcoin price has strong technicals

Bitcoin technical indicators also point to the possibility of further upside in January. On the weekly chart, Bitcoin has formed a bullish pennant pattern, shown in blue. This pattern consists of a long vertical line followed by a triangle-shaped consolidation. The final sideways movement is part of this pennant formation.

Bitcoin's uptrend is supported by the 50-week and 100-week EMAs, indicating that the uptrend remains intact. the Market value and relative value The index has been moved to 2.4, which means it is still cheap.

More importantly, Bitcoin has not yet reached the target of the cup and handle pattern. The cup forming depth is 75%. Measuring the same distance from the top side of the cup indicates a target of $123,000.

Source link