Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

Trading activity around the main cryptocurrency on the market, Dogecoin (DOGE)has recently experienced abnormal activity. In particular, as it became known thanks to data from Queen GlassA major flaw arose in the liquidation of DOGE perpetual futures positions, when the short liquidation amount exceeded the figure for long positions by 400%.

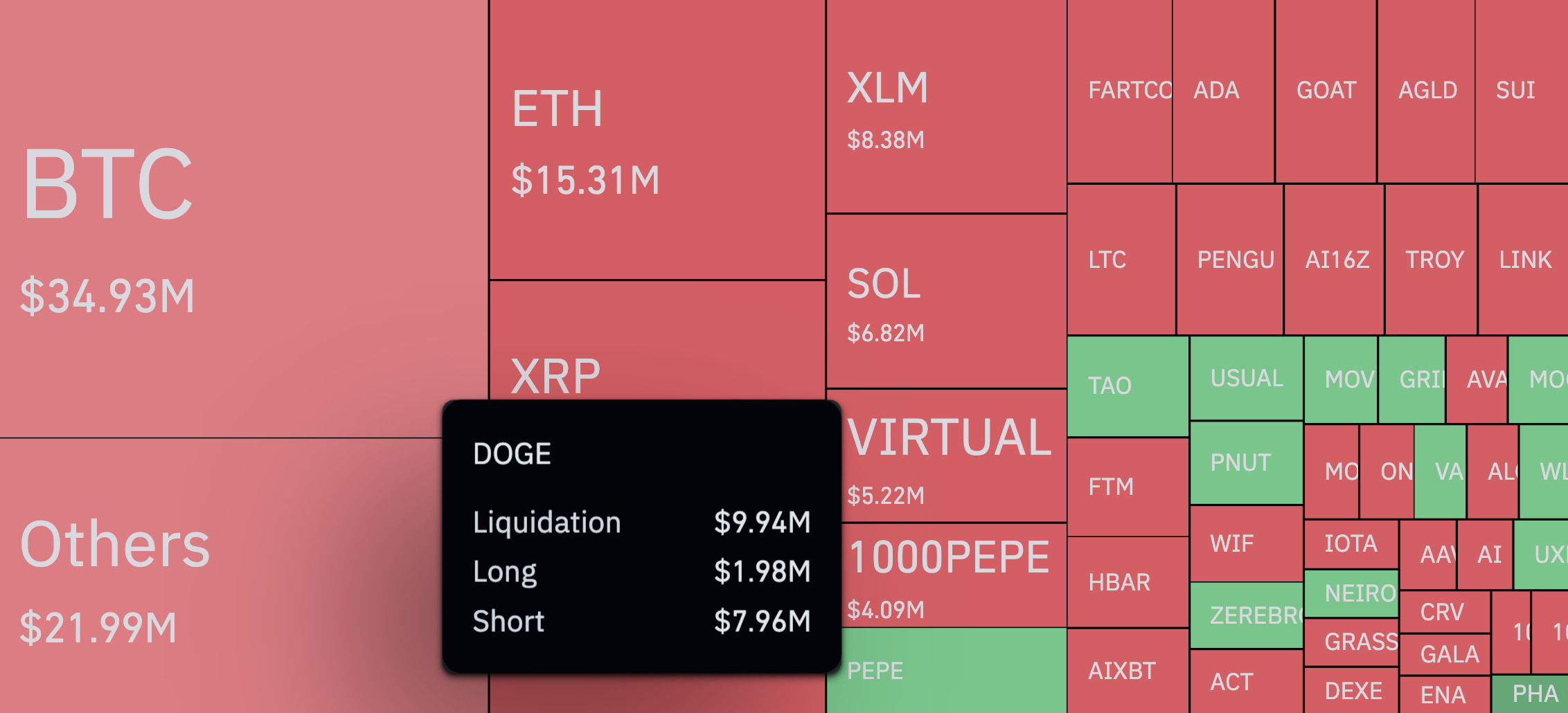

Thus, if the total amount Dogecoin Liquidated positions amounted to US$9.94 million, of which US$1.98 million were long positions and US$7.96 million were short positions. This imbalance is explained by the 6% price rise that Dogecoin showed over a 24-hour period.

As it turns out, many did not believe that the popular meme coin could make such a strong move and placed their bets on the bearish side.

It's not just that short pants tend to hurt more than long pants Doug It is only seen as a broader market trend, with $201.55 million liquidated in 24 hours, $139.74 million short positions and $61.81 million long positions.

The bulls are in control

This is probably due to price bounces and spikes that no one expected, and shows that trading cryptocurrencies, especially perpetual futures, is risky at the moment. Traders should be careful at the beginning of the new year as the market can change suddenly and lead to significant financial losses.

The truth is that it is still a weak market with many people enjoying the weekend and not watching the digital asset charts.

From another point of view, it is clear that the view of most market participants, at least currently, is towards a continuation of the bull market. After what happened in November, it seems logical that many will expect the same in January as in the second round.

Source link