This is part of the Forward Guidance newsletter. To read the full editions, Subscribe.

Therefore, the Fed cut interest rates by 25 basis points yesterday, which affected the markets. Hell, we even escaped address Talking about the Santa gathering that was about to happen. Sorry. It happens.

But what does it give? What really happened? Let's break it down.

While the FOMC meeting is in session, a host of factors come together to create the tension that drives the price outcome of the event. This combination of market expectations depends on the future guidance of the Federal Open Market Committee (name that newsletter!) and the positions of the market players who will be participating in the event in relation to those expectations. Let's break the two down.

Expectations

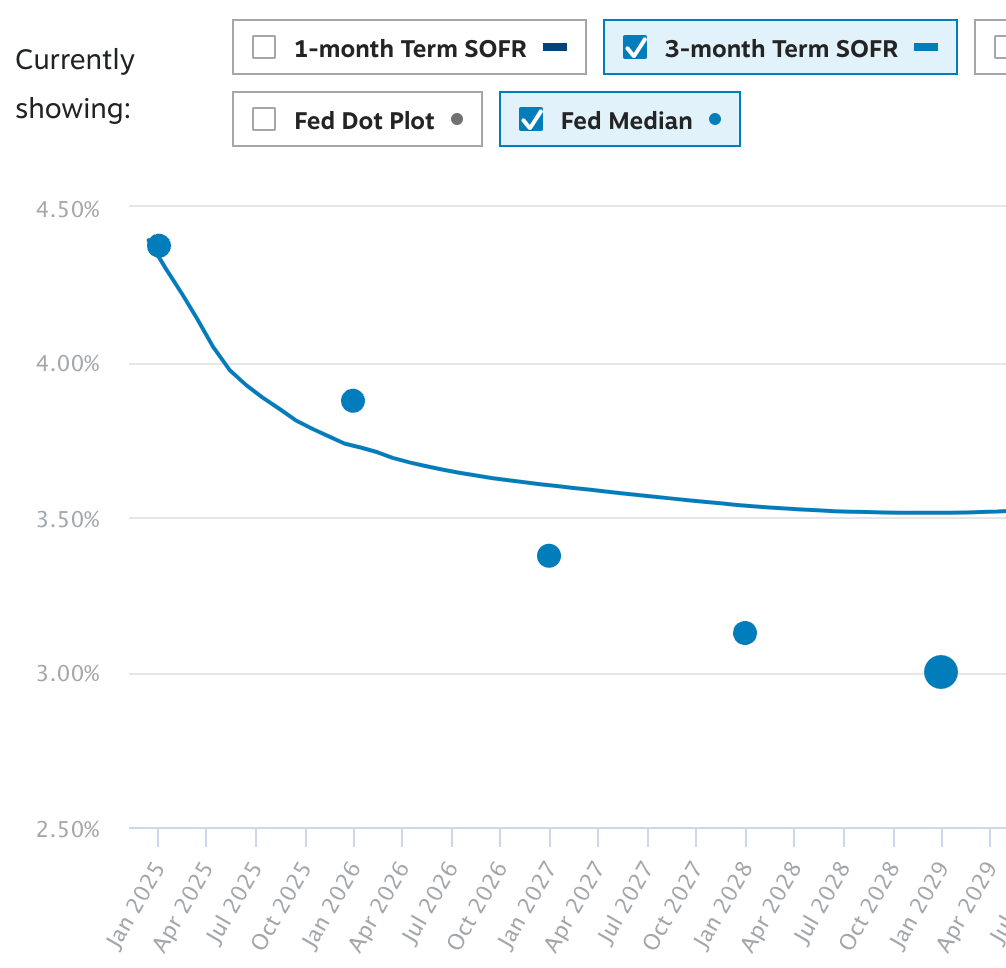

At the start of the meeting, the SOFR curve, which can be viewed as the market's implied expectation of the path of the federal funds rate toward the final interest rate, had moved significantly away from the Fed's previous summary of the expected economic outlook as of September.

This largely reflects a major upward phase shift in economic strength and labor market flexibility, requiring smaller interest rate cuts than everyone expected in September.

In 2025, the market was expecting rate cuts only three times. So, to surprise the market on the extreme side of things, the hurdle was too high to make it happen.

To my surprise, the FOMC managed to do this while also cutting interest rates yesterday. Falcons cut? What a good time to be alive.

By raising the expected federal funds rate to 3.9% (from 3.4%), the FOMC expected only two cuts in 2025 versus an already tight market that expected three cuts.

This reduction in the amount of cuts was largely driven by increased uncertainty about the path of inflation in the next 12 months, as shown here:

All of this information is distilled into this simple step - the second point here moves above market expectations in 2025:

Now what made this move so brutal yesterday? Part Two: Positioning.

Positioning

A trio of positional dynamics came together to create the perfect ignition, igniting the fire that was yesterday. As Tyler Neville (co-host of the report) discusses here, with the VIX low in the event, the systematic rally was aggressively long:

Furthermore, there was widespread expectation that seasonal dynamics in the markets (i.e. the Santa rise we mentioned yesterday) would take us to the promised land. This led to everyone piling into the same trade for riskier assets under the assumption that Powell's dovish policy would continue.

Finally, we have the largest options expiration in history happening this week. With such large open interest, traders who have to hedge their exposure to delta end up chasing gamma in a reflexive manner that amplifies moves in the markets. This also led to yesterday's acceleration.

As always, there is no single reason for market movements on any given day. What's more, it's a variety of factors that come together to cause the outcome. Some days, these moves end up being quite dramatic, as we saw yesterday.

Start your day with the best cryptocurrency insights from David Kanellis and Katherine Ross. Subscribe to the Empire Newsletter.

Explore the growing intersection between cryptocurrencies, macroeconomics, politics, and finance with Ben Strack, Casey Wagner, and Felix Goffin. Subscribe to the Forward Way Newsletter.

Get alpha straight to your inbox with 0xResearch Newsletter - Market highlights, charts, trade ideas, management updates, and more.

The Lightspeed Newsletter has everything Solana, in your inbox every day. Subscribe to Solana Daily News By Jack Kopenick and Jeff Albus.

Source link