Cryptocurrency expert Ali says Dogecoin could rise by 6,780% if it remains in an ascending parallel channel pattern.

Cryptocurrency analyst Ali took toDoug) remains in a continuous upward parallel channel pattern. While there is excitement about DOGE's future, looking at price action and technical indicators provides a more solid overview of where the cryptocurrency currently stands.

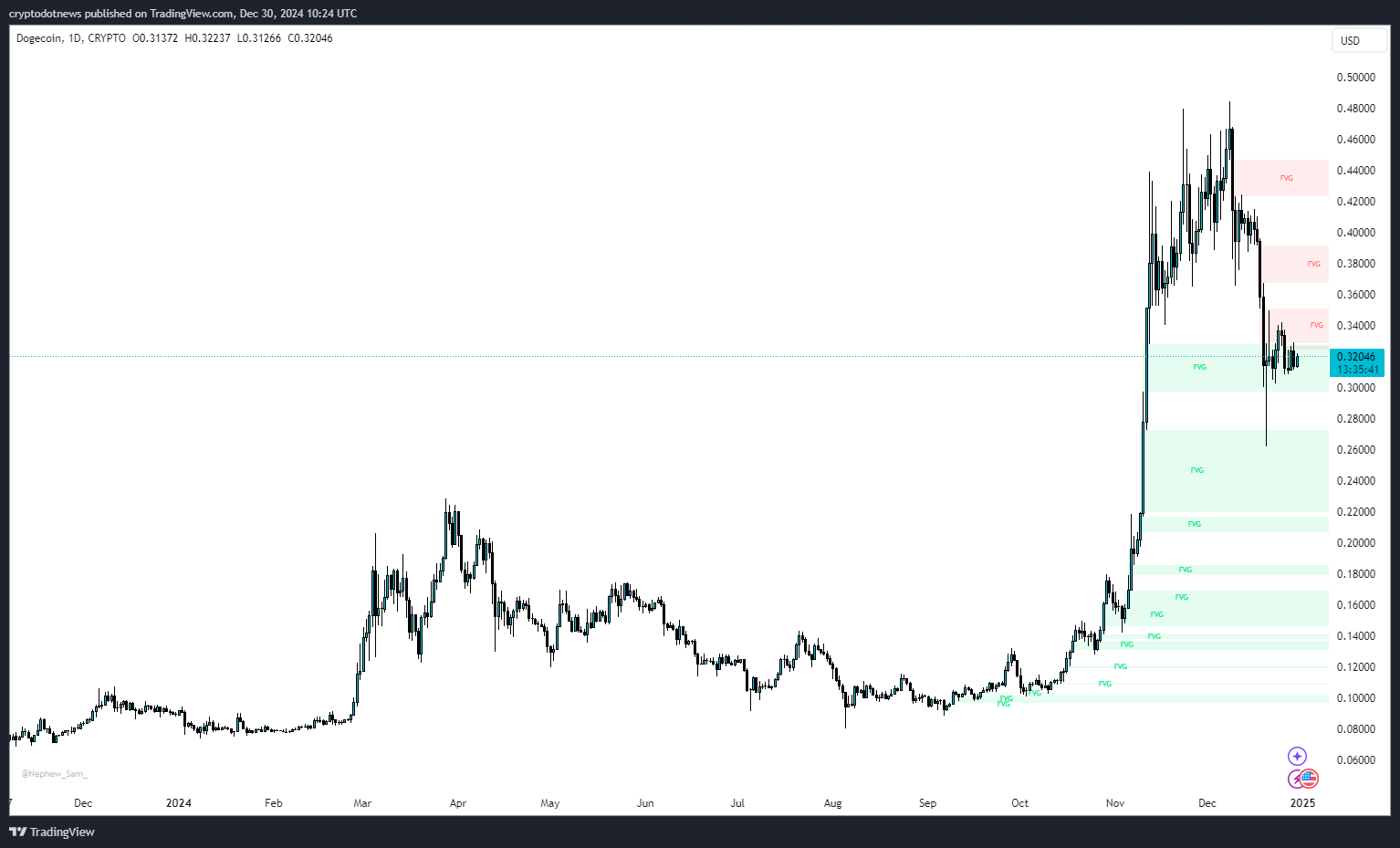

DOGE is trading at $0.3215 after peaking at over $0.50 earlier this year and settling lower. The price appears to be trading in a range where $0.30 represents important support and $0.35 to $0.40 represents important resistance. These levels correspond to historical fair value gaps (FVG), areas of unfilled liquidity, and areas of potential future correction.

The price was recently rejected near the $0.45 resistance area, indicating selling pressure at higher levels. Consolidation in the range of $0.30 to $0.32 indicates this Doug It is trying to find a bottom, but several FVGs below $0.30 could open up to lower targets if the bears continue to pressure the market.

The moving average convergence divergence shows a bearish crossover, with... Macd It is trending below the signal line. This suggested that the bears' bullish momentum was on the rise, especially after the decline from the November highs. There will be longer red bars in the chart, indicating increased selling pressure as DOGE fails to tighten above higher levels.

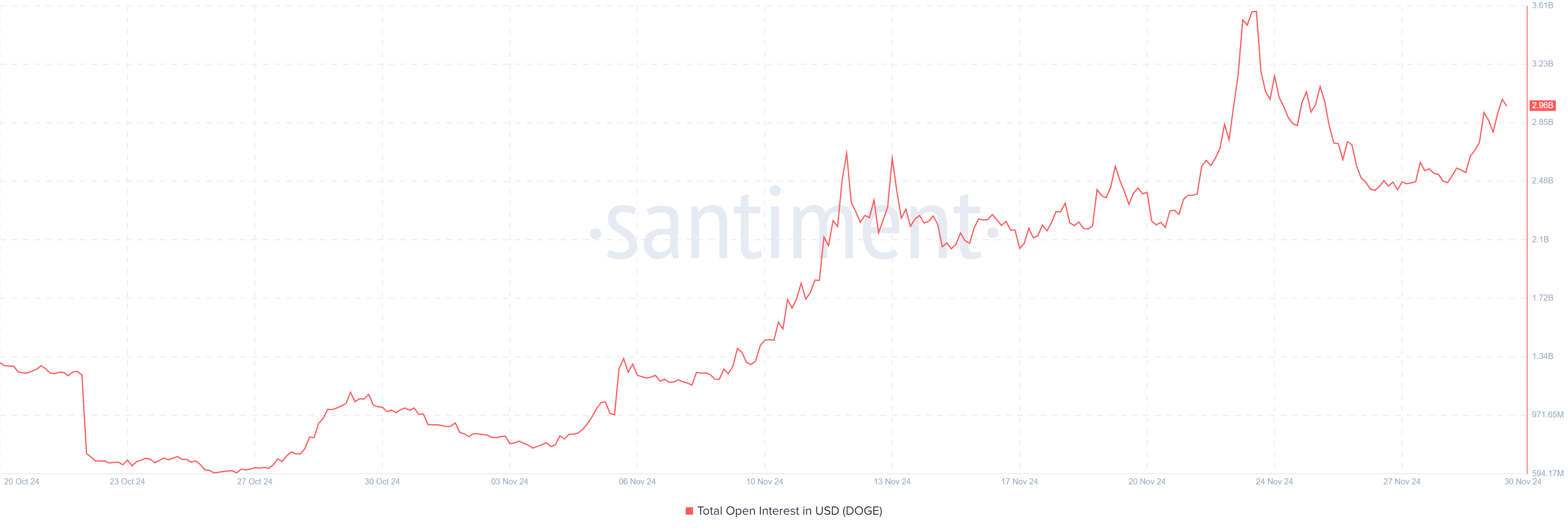

DOGE Sentiment is Mixed As the current market sentiment around it is mixed and somewhat dependent on the overall market conditions. Although it retains support from its loyal fan base, macroeconomic uncertainty and broader cryptocurrency market conditions have tempered bullish excitement. Also, a large portion of the DOGE market is speculation based on open interest data, which, of course, poses a concern for the stability of the token during times of low market activity.

DOGE is in a consolidation phase, with the $0.30 to $0.32 and $0.35 to $0.40 buy zones acting as major resistances. bearish Momentum remains according to technical indicators, such as MACD and open interest. However, the downside risk is the large liquidity gap below. To regain upward momentum and continue its upward trajectory, DOGE must regain key resistance areas and its upward momentum.

Source link