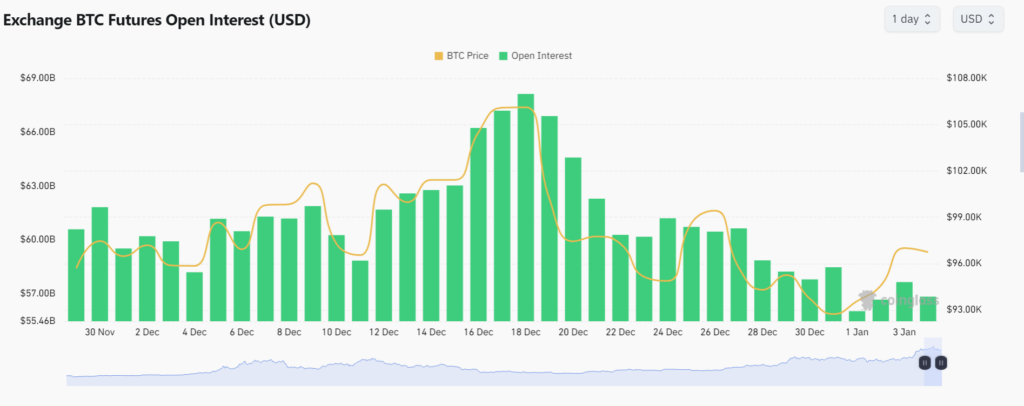

Open interest in Bitcoin futures fell to $56.6 billion, after falling at the beginning of 2025. Since then, BTC OI has not been able to recover and has returned to the November ATH.

According to data from QuinglassBitcoin (Bitcoin) OI fell to $56.6 billion on January 3 despite showing signs of recovery just a day earlier. On January 1, the value of BTC OI fell to its lowest level in the past two months, and was only able to reach a total of $56.03 billion.

Earlier today, BTC OI seemed to give traders hope when it reached just over $57 billion, but it has since fallen to $56 billion.

Throughout December, Bitcoin's total open interest reached new heights. In fact, BTC OI reached an all-time high on December 18 when it peaked at $68.13 billion, with CME being its largest shareholder with $22.7 billion.

Since BTC OI reached roughly $70 billion, it was on a downward slope that ended on January 1 when it fell to $56 billion.

Bitcoin open interest is a metric used to measure the amount of futures contracts linked to Bitcoin used by it Crypto exchanges. The higher the interest level, the greater the demand and liquidation for crypto assets.

At the time of writing, BTC OI still fails to cross the $60 billion threshold. In fact, it has returned to its previous all-time high, which reached $57 billion on November 22. So far it shows no signs of recovery any time soon.

Data from Coinglass shows this Continuing medical education He is the largest shareholder of BTC OI. CME currently provides approximately 30% of the total open interest in Bitcoin futures with 172,650 BTC OI which is worth $16.7 billion at current prices.

Binance It is the second largest contributor to BTC OI, with 21.3% of the total coming from the leading cryptocurrency exchange. Binance has 126,770 BTC OI worth $12.3 billion. After Binance Bybit It ranks third with $7.83 billion in BTC OI, equivalent to 13.5% of the total BTC OI.

Source link