Bitcoin prices continued to rise over the weekend, reaching a high of $98,300 after finding crucial support at $91,405.

The largest cryptocurrency by market capitalization has risen for six consecutive days, coinciding with ongoing demand and supply dynamics.

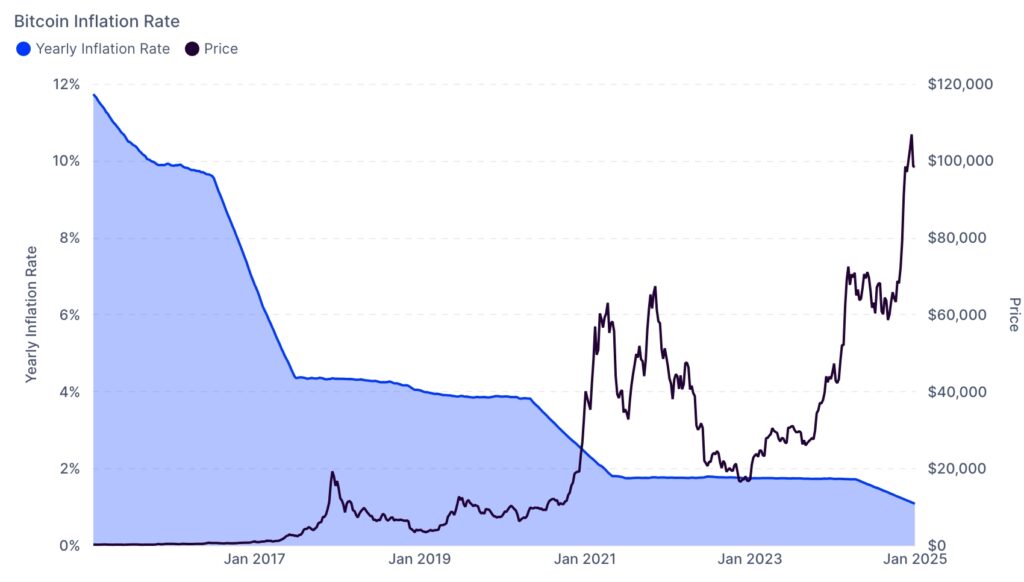

On the supply side, mining difficulty and hash rate metrics have jumped to record highs since the recent halving event in April. This trend has pushed the currency inflation rate to 1.11%, which is well below the US CPI figure of 2.7%.

It is also less than 12% compared to 2016, while the amount of Bitcoin (Bitcoin) on stock exchanges continued to decline.

On the other hand, demand is rising as ETF inflows continue. These funds have accumulated over $128 billion in assets, with BlackRock having over $54 billion in IBIT assets.

MicroStrategy also continued its buying spree and now owns over 450 coins. Polymarket users We expect the company to have over 500,000 coins in stock by March.

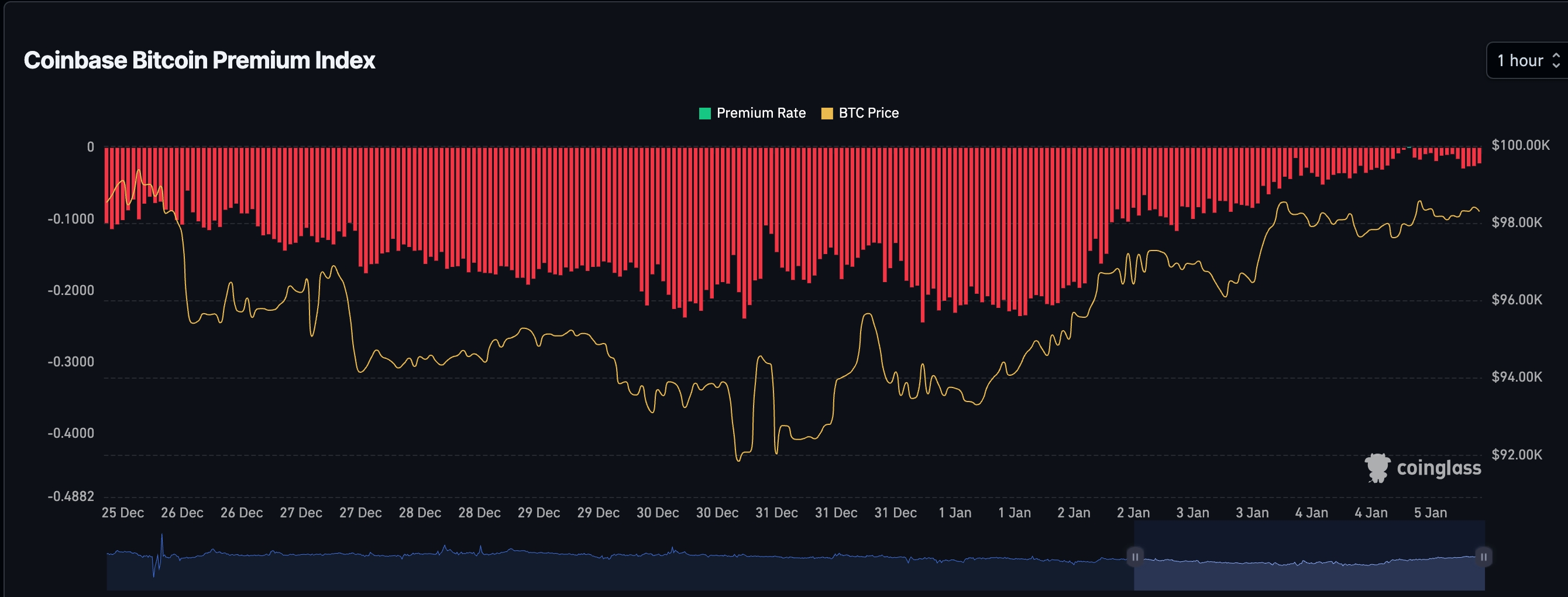

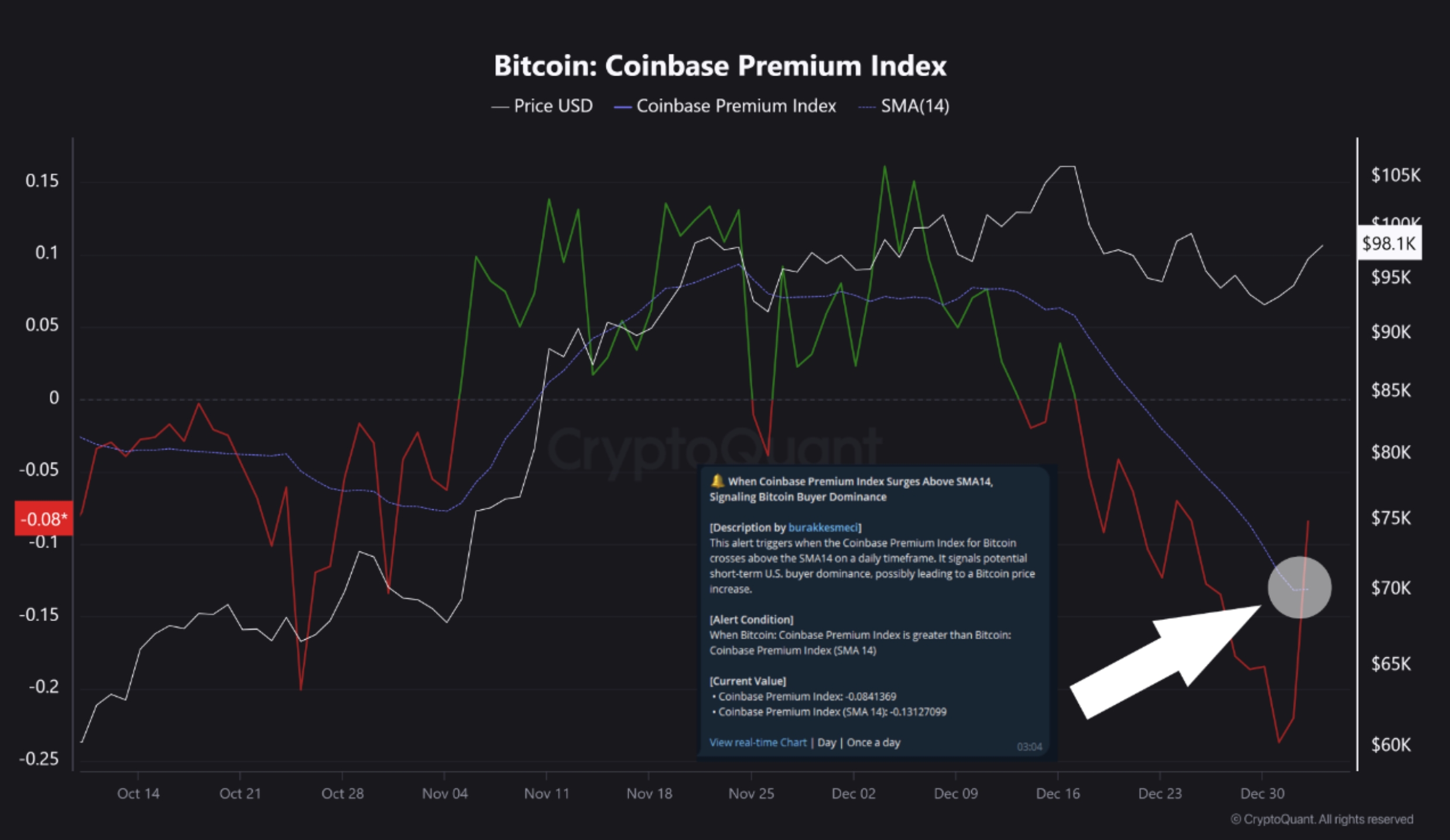

There are signs that US investors are buying more Bitcoin. In addition to their ETF purchases, data shows that the Coinbase Premium Index has recovered after falling sharply in December.

according to Queen Glassit moved to -0.021, up from -0.24 in December.

Other data from CryptoQuant shows that the indicator broke above the 14-day simple moving average after 26 days – a positive signal for prices.

The Coinbase Premium Index is an important index that examines purchases by US investors, including institutions. Coinbase is the most widely used exchange in the United States, so when it rises, it indicates the potential for the largest pool of capital to be accumulated.

Additionally, Bitcoin faces other fundamental catalysts ahead, including the inauguration of President-elect Donald Trump and the upcoming presidency. $16 Trillion FTX Distribution.

There are chances that some of the beneficiaries of this money will invest in Bitcoin and other coins. Also, as crypto.news reported last week, Bitcoin MVRV ratio It is still low - a sign that it is undervalued.

Bitcoin price analysis

The daily chart shows that BTC has rebounded in the past few days. It has been rising for the past six days in a row and has consistently remained above the 50-day moving average.

Bitcoin also found significant support at the key support level at $91,400, where it has failed to fall several times since December.

So, there are chances that it will continue to rise as the bulls target the all-time high of $108,000. A move above this level indicates further gains, potentially reaching the 38.2% Fibonacci retracement point at $114,000.

However, forming a head and shoulders pattern is risky. This could lead to a downside breakdown below $91,400.

Bearish analyst position

WhaleWire analyst Jacob King recently issued a stark warning about Bitcoin and the broader cryptocurrency market, citing signs of a potential bear market.

In a social media post, King highlighted several developments, including MicroStrategy reducing its Bitcoin purchases, and El Salvador appearing to... Shift away From policies focused on cryptocurrencies, BlackRock sold significant holdings of BTC.

King criticized MicroStrategy as a "giant scam" and unsustainable. He also noted that Tether (USDT) has temporarily stopped minting new coins for more than 20 days, coinciding with the recent slump in token prices.

King described the situation as “the calm before the storm,” warned that the decline in cryptocurrencies could be in line with a broader stock market collapse, and urged investors to reassess their risks.

At last check on Sunday, Bitcoin was trading at $98,035.

Source link