Disclosure: This article does not constitute investment advice. The content and materials contained on this page are for educational purposes only.

MANTRA is eyeing $10 as analysts expect explosive growth, supported by strong adoption, key partnerships and a focus on regulated RWA tokenization.

MANTRA (OM) price is currently hovering at $3.91, just below its high point this week. This movement raised the market value of the currency to more than $3.74 billion. Despite the decline, MANTRA is gaining significant interest in the blockchain space, and analysts predict significant growth in 2025.

As of now, mascot The RWA tokenization space leads the organization as the first layer-one blockchain designed specifically for this purpose. According to projections, the project is poised to capture a significant share of the RWA tokenization market worth over $16 trillion by 2030.

Additionally, MANTRA's partnerships with Google Cloud, MAG, Zand Bank and Pyse have provided the project with the boost it needed. In addition, the increasing reliance on Mantra, especially in the UAE, indicates investor confidence.

When compared to other tier-1 blockchains like Solana and Sui, MANTRA stands out for its focus on regulation-compliant RWA tokenization. Analysts believe This approach It gives OM an advantage in the blockchain ecosystem.

Long term vision mantra It implies an on-chain total value locked (TVL) of US$100 billion by 2026. With the current market capitalization at US$3.74 billion, this means there is plenty of room for growth. Experts say OM could easily see a 10x increase in the long term, with a more realistic price target of 3x to $10 in the short term.

Mantra is getting ready to break through

Oh The chart is forming a bullish flag pattern in the accumulation zone, indicating a strong breakout potential. The pattern shows steadily higher lows as selling pressure declines, indicating strong accumulation by institutional investors. This technical setup, combined with rising volume profiles, mirrors patterns seen in other successful Layer 1 blockchains prior to their parabolic moves.

With strong support at $3.60 and resistance at $4.10, the coin may be poised for a potential rally. If OM can break the $4.60 mark, analysts believe there could be a sharp rally, with target prices reaching $10. Increasing institutional adoption and ecosystem growth are fueling these optimistic forecasts.

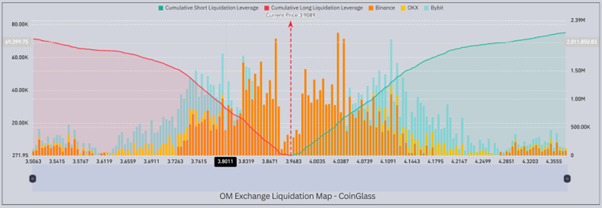

In the past 30 days, short positions on OM have been liquidated in large quantities, which may indicate possible price pressure. In the past 24 hours, over $2 million in short trades have been liquidated. In the past 7 days, more than $9 million has been liquidated, and in the last 30 days, more than $20 million in short trades have been liquidated.

This increasing trend of short liquidation, compared to long positions, indicates strong buying pressure and the potential for an explosive upward move, similar to patterns seen in previous crypto bull runs.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users should conduct their own research before taking any actions regarding the Company.

Source link