Disclaimer: The opinions expressed by our writers are their own and do not represent the opinions of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

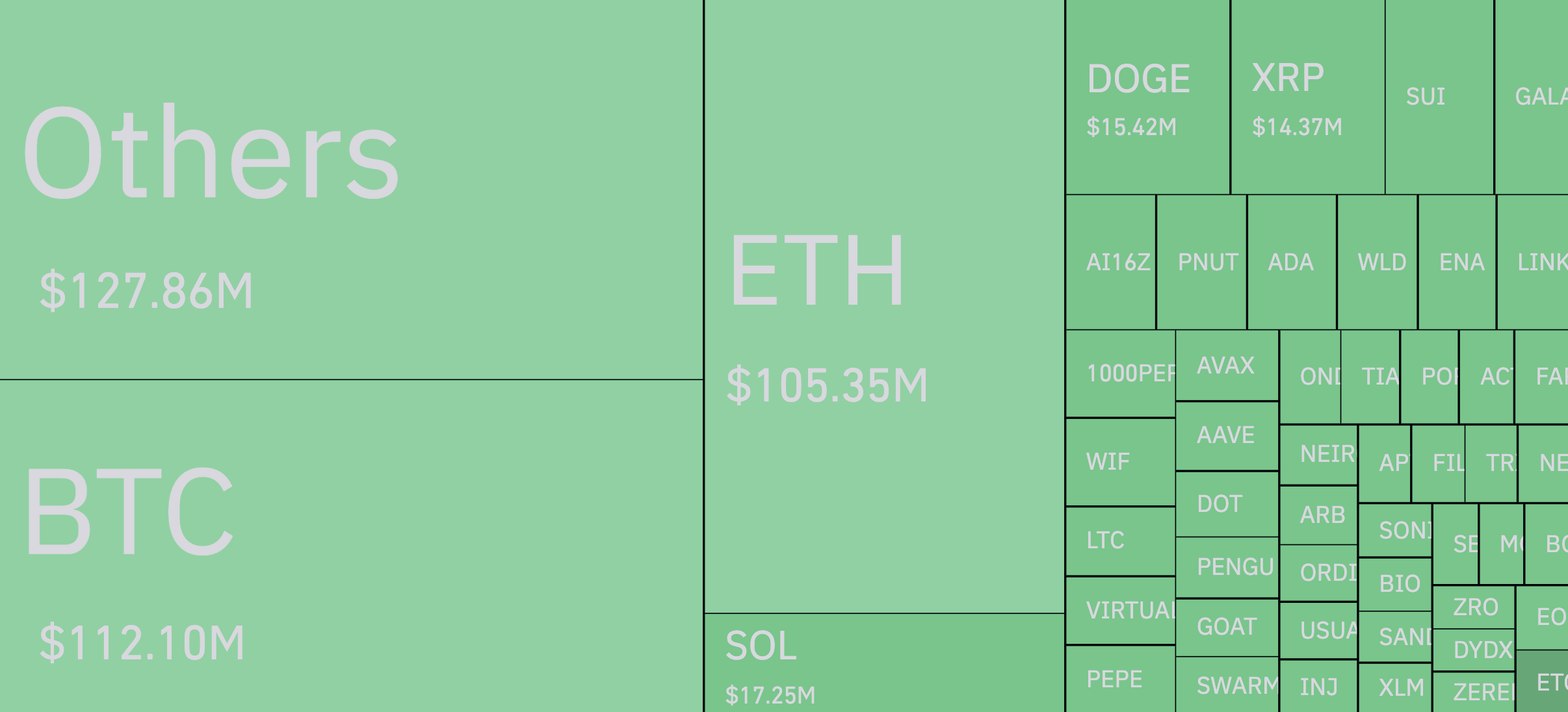

According to data from Queen GlassThe volume of liquidations of permanent futures contracts on crypto assets exceeded half a billion dollars during the past 24 hours. This could be the largest liquidation event since the start of 2025, with $461.29 million lost in long trades and $71.39 million in short trades.

Amid the selling, the price of the leading cryptocurrency rose, Bitcoin (BTC)It fell to its lowest level in two months. The last time Bitcoin traded at this low level was in mid-November. The difference is that at the time, the price of BTC was rising. However, we are now seeing the cryptocurrency fall below this price point.

Traders like Peter Brandt View the recent sell-off as confirmation of the head and shoulders pattern. If validated, Bitcoin price could see the end of its suffering at just around $77,000.

Coincidentally or not, this is exactly the level of the unclosed gap on the Chicago Mercantile Exchange Bitcoin Futures contracts. It was formed by the rapid pumping of the asset in November and leaving it open, acting as a magnet for the price to return one day. One would think the time has come.

Altcoin Season – Is It Late?

As you can see, no one is left unscathed, and both bears and bulls - especially the latter - are being punished by the market decline.

It is not even the over-leveraged positions that fall first, but the leverage itself, as the price of most of them Alternative cryptocurrencies They experience a double-digit decline, and even those who think their leverage is safe receive margin call notices.

Unsurprisingly, $127.86 million of the total is accounted for by “others,” which includes all small-cap altcoins. These are the most affected by the accident.

Source link