Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

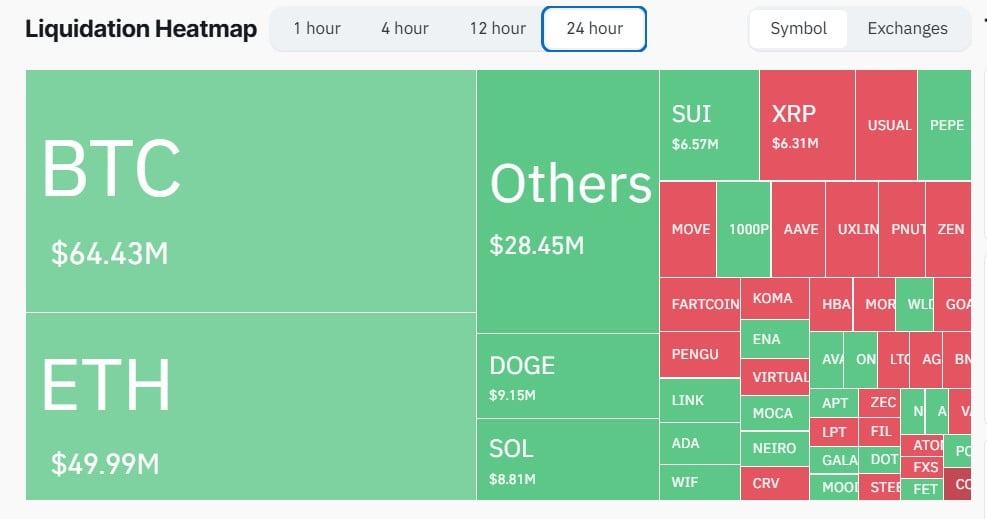

Volatility in the crypto market is Thinningalso showed the main liquidation numbers. Data from the CoinGlass link shows that these liquidations totaled $240 million over the past 24 hours. This is a significant deviation from the more than $1 billion recorded on at least two occasions over the past week.

Spotlight on Bitcoin, Dogecoin and XRP

According to liquidation figures, the significant decline in Bitcoin price to the $94,000 range has left long-term traders unaware. According to the numbers, the total liquidations reach $64.92 million, bringing Bitcoin traders' losses to $44 million. Short traders' liquidations represented $20.92 million.

XRP saw a smaller liquidation of $6.57 million. In the case of XRP, short traders suffered the largest losses of $3.65 million, while long traders accounted for the rest. Over the past week, XRP has seen sweet and sour trends with the currency Seeing parabolic growth in portfolios Amid gains of 253% over the past month.

Dogecoin received $9.2 million in liquidations, split almost evenly between long and short traders. This means that DOGE traders are unsure about the coin's next move amid a record of widespread volatility.

Where does the market go next?

With lower volatility, Bitcoin price has entered a consolidation phase in defiance of Santa's rally.

The coin fell 1.45% in 24 hours to $93,907.15 at the time of writing. Effectively, Bitcoin's price is down 13% from its all-time high (ATH) of $108,268.45 that it reached seven days ago.

Like other altcoins, XRP and DOGE maintain a very high correlation with Bitcoin, a trend that may limit the growth of both currencies. in spite of Whale activities Around these assets and other fundamentals, any support from Bitcoin may not lead to long drawdowns.

Source link