This is part of the empire newsletter. To read full editions, Subscribe.

Today it represents 799 from the Bitcoin Market.

This is about 26 and a half months of positive work. A little more than two years. Cheers for that!

It is difficult to say exactly when the bull markets start and end in encryption. Ancient world Definitions - Based on 20 % of the retrieval of local high levels, etc. - they have no power here.

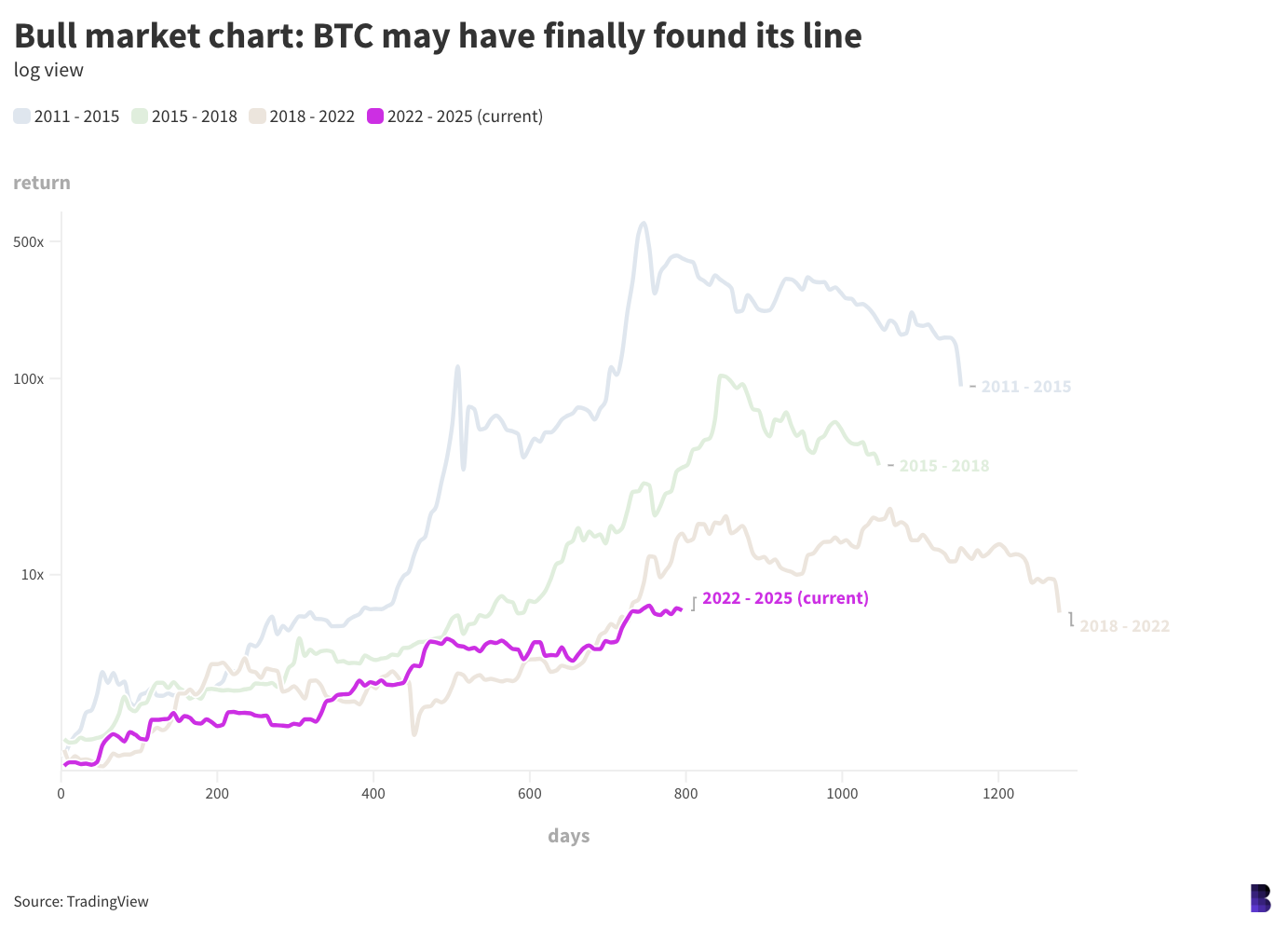

Withdrawal operations of this size only It often happens in the way. However, through my very difficult estimates, the last three Bitcoin Bull markets until 2011, on average, have continued somewhere in the 1,000 -day area.

Therefore, it usually raises that Bitcoin takes less than three years from the bottom of the previous bear market, and even the summits of the tournament, to an accident in the past, clearly putting an end to any upward path.

Good news: Bitcoin looks very healthy in this course when set to the previous three. Even after this correction.

Bitcoin's performance is shown during this emerging market - which started at the end of 2022 - so far on the above chart in the record display. This has been done 6.6X so far, from 15474 dollars to $ 99,000 from this morning.

Notice how, for most of the course, BTC was tracked forward or below the brown line directly, which it plans to perform during the previous bull cycle between 2018 and 2022.

BTC diverged about 50 days, at the beginning of December. But it's okay: We already know Bitcoin's return Reducing each course.

Its current path best suits the style - all the emerging market courses followed a similar path, as it is less clear every time.

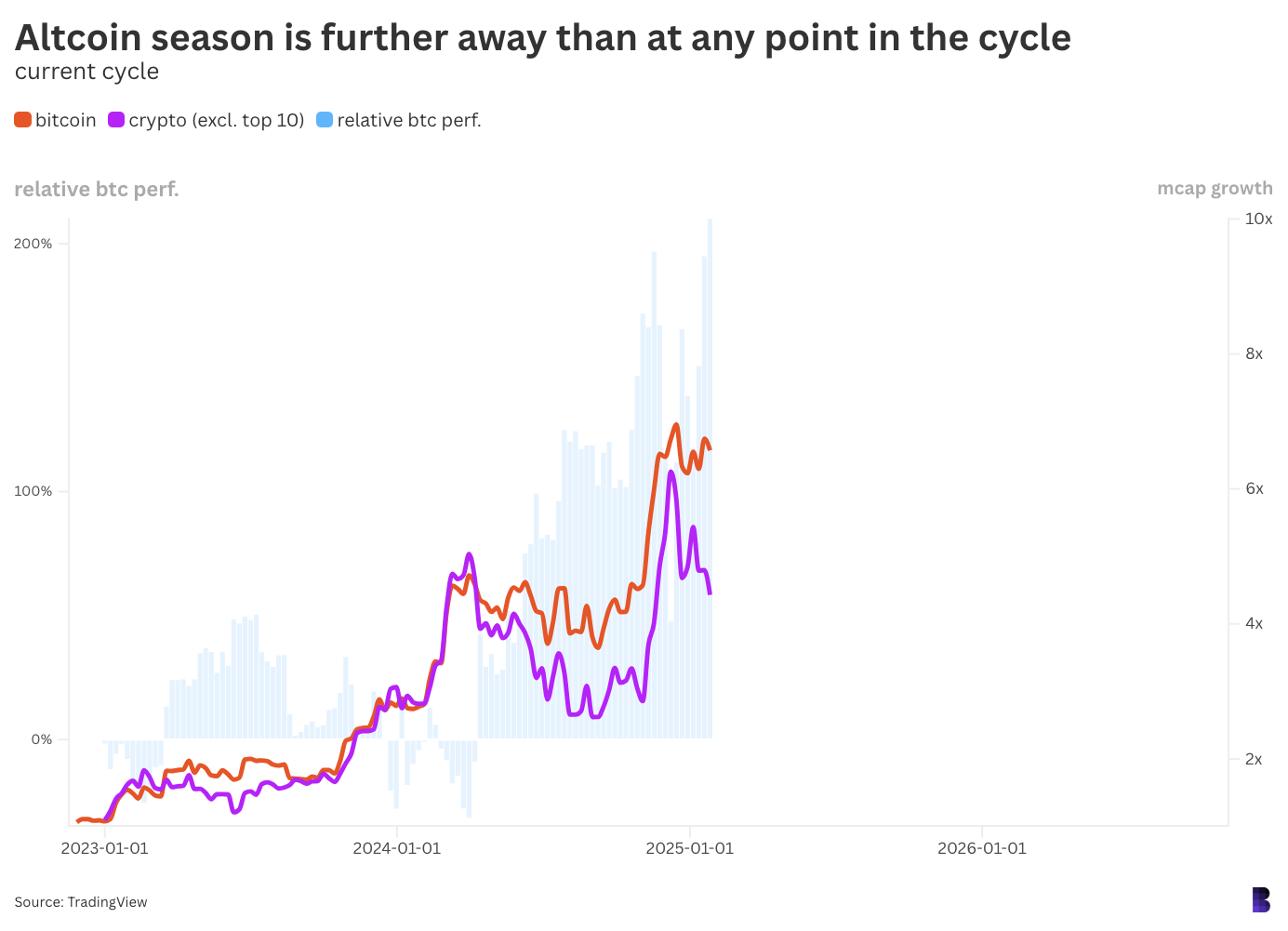

Bad news: We are not closer to the Altcoin Bonafide season, even after large gatherings in coins such as XRP and TROMP.

This one draws the growth of the maximum market from the Bitcoin (orange) and Altcoin (purple) market for this bull market. As you can see, Altcoins suffers from deeper losses but still do 4.4x.

Blue columns in the background of Bitcoin's relative performance to Altcoins - Bitcoin now appear more than 210 % before Altcoins, the largest distance from the cycle. This is too much for anything The real altcoin season.

Like Taurus and Bear Markets, "Altcoin Season" has no official definition. It is more than Vibi.

empire I did that It is better to appreciate itAltcoin seasons are likely to start when the market gap grows over the Altcoin market, through the emerging market so far, bitcoin.

The Altcoin season is confirmed only when Altcoins outperformed Bitcoin for 90 consecutive days or more.

It looks ninety days a lot, but the rear test with these conditions provides three distinguished seasons from Altcoin throughout the history of Crypto:

- Earmeum ICO early roles between mid -2016 and early 2018,

- The first half of 2019 when many bitcoin outperformed bitcoin, and

- Most of 2020 Divi summer to the highest level in Crypto at all in November 2021.

The next altcoin season may look very different. Currently, everything is still about bitcoin.

Start your day with the highest visions of encryption from David Kanis and Catherine Ross. Subscribe to the newsletter of the empire.

Explore the increased intersection between encryption, macroeconomic, politics and financing with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the guideline newsletter forward.

Get alpha directly in your inbox with 0xresearch newsletter - The most prominent market, charts, Degen commercial ideas, governance updates, and more.

The newsletter of light is all the Solana things, in your in the inbox, every day. Subscribe to Solana Daily Solana News From Jack Kubinic and Jeff Albous.

Source link