For the first time, the Tax Authority has successfully sued the case of tax fraud that involves encryption.

The American internal revenue service won a great victory, as a legal precedent was placed in the fight against tax fraud. In December 2024, Frank Richard III was sentenced to two years in prison and a fine of $ 1.1 million for evading tax sales. On January 27 Blog postThe Blockchain Analysis Company said that the ruling analyzes are the first time that the Tax Supervision Authority has obtained a condemnation of tax fraud on digital assets only.

"Outside the Tax Authority, the issue also represents a major victory for the Ministry of Justice and Justice worldwide."

series

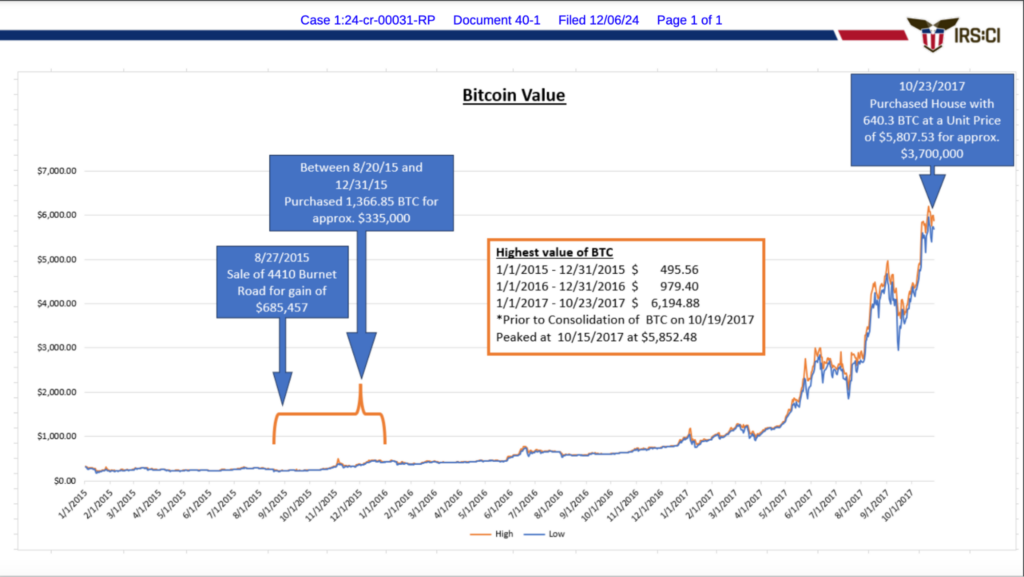

The case is linked to AHLGREN to buy a $ 4 million house in Park City, Utah, using Bitcoin's profits (BTC) sales. The New York -based company says that the AHLGREN methods were largely detailed: He sold millions in BTC using tools such as Coinjoin Mixers, Wasabi Wallet, peer services to the counterpart, and even structural monetary deposits to hide profits. He also modified his tax files to show less value for encryption.

However, investigators are still tracking the AHLGREN encryption transactions via multiple governors and exchanges. For each series of analysis, his fortune came from the 2015 purchase of the process of 1,366 BTC for about $ 676,170.

"Although Ahlgrin thwarted the authorities for a period of conducting some accounts, his condemnation and the issuance of the ruling clarify how tax evasion can be tracked on the series and has severe consequences in the world."

series

Meanwhile, Senator Ted Cruz of Texas is preparing to challenge a new encryption base in the Tax Authority using Congress Review Law. Al Qaeda forces decentralized codes to collect customer information, such as names and addresses, and send tax models to users.

As Crypto.News I mentioned earlierCruz, along with Senator Cenatia Lomes, Bill Hajri and Tim Shihi, goes to cancel what Republicans call the "midnight rules" by Biden Administration. These regulations have been completed late last year, and Cra gives Congress until mid -May to cancel them. CRA allows decisions to overcome the depths of the Senate, as it only needs the majority of the majority of both rooms to pass.

Source link