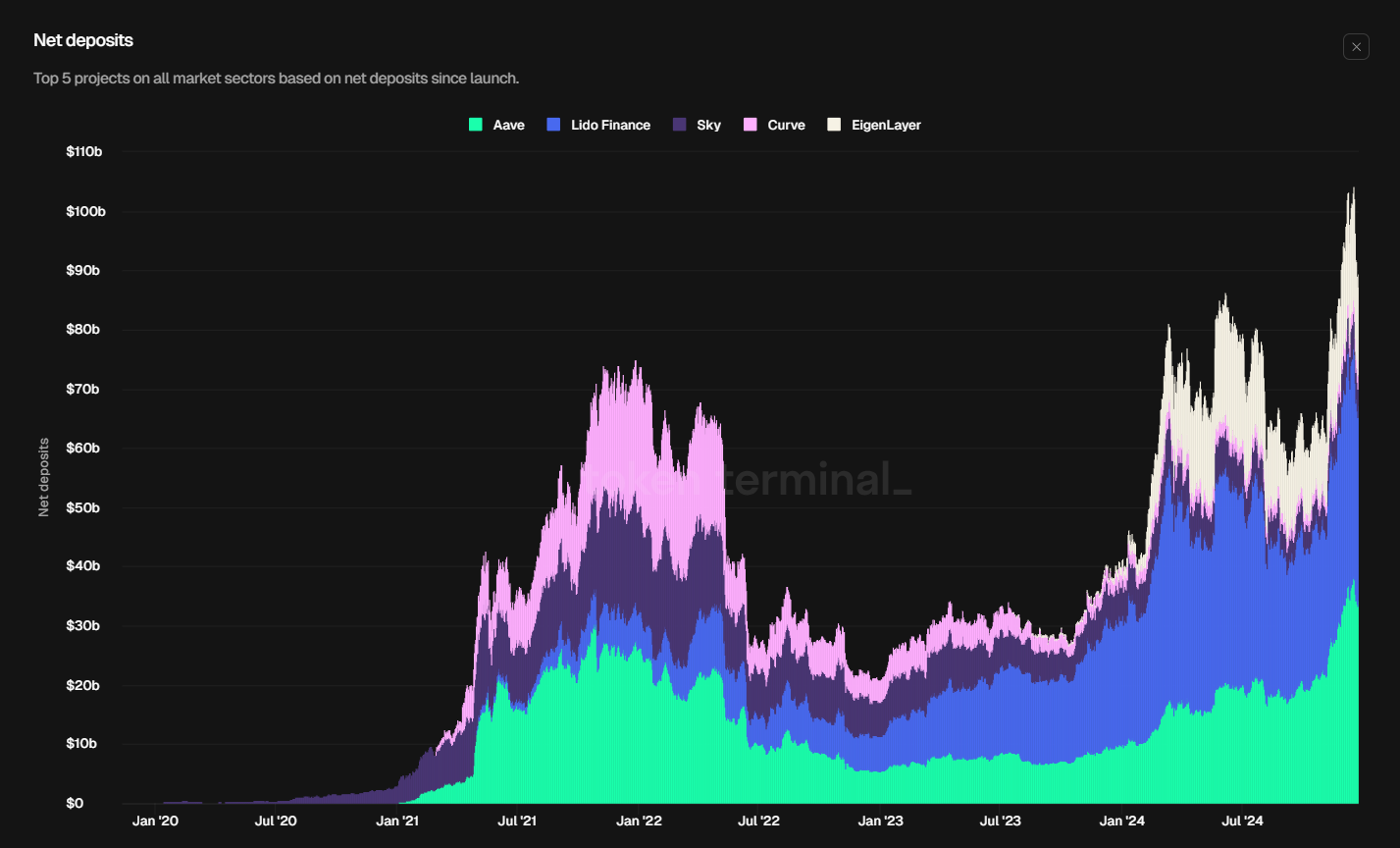

Aave and Lido together surpassed $70 billion in net deposits for the first time in history, according to Token Terminal.

ghost (ghost) in the leading position with $34.3 billion, just ahead of Lido Finance (LDO) $33.4 billion. Together, the two protocols represent 75.25% of the $89.52 billion allocated to the five largest decentralized applications, the highest percentage ever, in December 2024. Together, the two projects represent 45.5% of the total funds allocated among the top 20 projects. Decentralized finance Orders, equivalent to US$67.42 billion out of total net deposits of US$148 billion across the sector. LDO leads with a total value of $33.8 billion, followed by AAVE at $20.6 billion.

Overall, the DeFi sector has seen growth, with YTD TVL rising by 107%, and at its peak on December 16, TVL reached $212 billion, marking the first time this value has ever exceeded $200 billion.

The revenue performance also highlights the strength of these protocols. AAVE made $12.5 million Over the past 30 days, it has grown by 27.5%, and the value of LDO has reached $9.6 million, thanks to the platform’s 24% growth.

In addition to deposits, the DeFi ecosystem also set a record high in trading volumes for decentralized exchanges, reaching nearly $380 billion throughout November, according to TheBlock. In fact, the share of trading volume executed on live trading platforms rather than centralized exchanges reached 13.86% in October, the second highest level ever recorded, after the 14.18% seen in May 2023.

DeFi Lending market It also grew significantly, with existing loans reaching $21 billion in December. This is the largest monthly number to date. Crop cultivation The stake represents one of the main tools of DeFi and constitutes a $200 billion stablecoin market. The tools allow users to earn rewards or borrow using stablecoins. They are leveraged through DEX exchanges and liquidity pools, allowing price slippage to be minimal only in highly active markets. Stablecoins can also migrate to different blockchain networks, increasing their versatility and ease of use.

Source link