Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

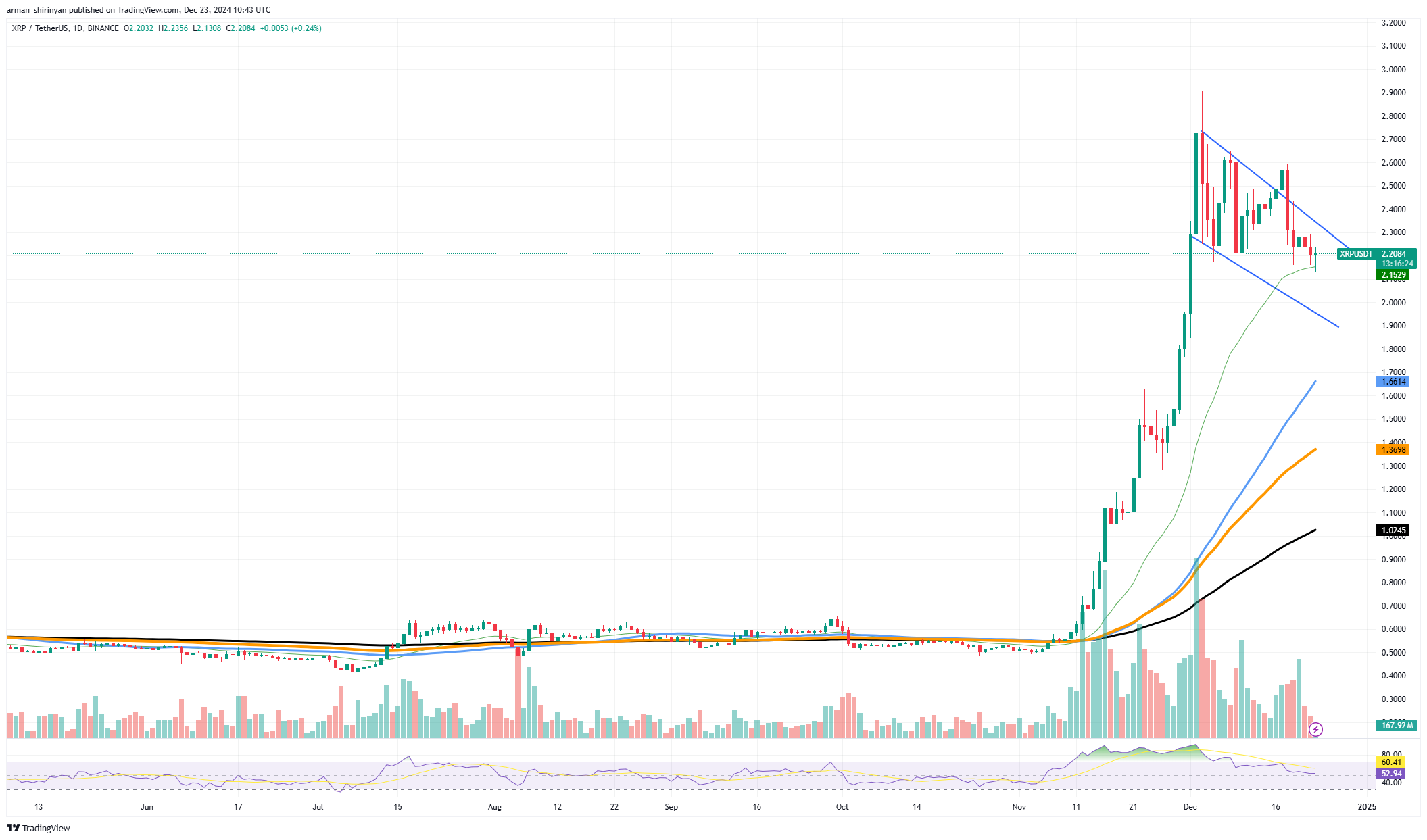

XRP has recently found support around the 26 Exponential Moving Average, an important level that often acts as a pivot for market sentiment. The asset price has shown consolidation in this area, indicating a potential reversal or further decline if the level fails to hold. With the 26 EMA acting as a critical support area, XRP Investors closely watch price action to gauge the next move It moves.

Payment Volume: XRP transaction volume rose earlier in December but has since declined, indicating reduced network activity.

Active Accounts: The number of unique senders has decreased significantly, indicating a decline in retail engagement.

Fee Burn: XRP was burned as fees peaked during the initial boom but has since stabilized, in line with decreased transaction activity.

if XRP If the price holds above the 26 EMA, it could indicate renewed buying interest, pushing the price towards $2.40 as first resistance. An increase in transaction volume could validate a recovery, with a potential rise to $2.60 or more. A rebound in active accounts and payment volume may attract more buyers, adding to the bullish momentum.

A close below the 26 EMA could lead to a further decline to $2.00, testing the next support area. A continued decline in network activity could erode market confidence, pushing XRP towards $1.90 or lower. If price action fails to match the increasing volume, this may indicate bearish divergence and further selling.

XRP's performance is based on maintaining the 26 EMA and has seen a rebound in on-chain activity. While current metrics point to caution, a decisive move above $2.40 could reignite bullish sentiment. Conversely, failure to hold crucial support could trigger another wave of selling pressure, making $2.00 the next key level to watch. for now, XRP It is at a crossroads, with potential for upside and downside depending on market conditions.

Source link