Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

The United States reported a higher-than-expected Consumer Price Index (CPI) for December, showing a monthly increase of 0.4% after seasonally adjusted, beating expectations of 0.3%. The annual rate of the Consumer Price Index rose to 2.9%, the highest level since July 2024, marking its third consecutive monthly increase.

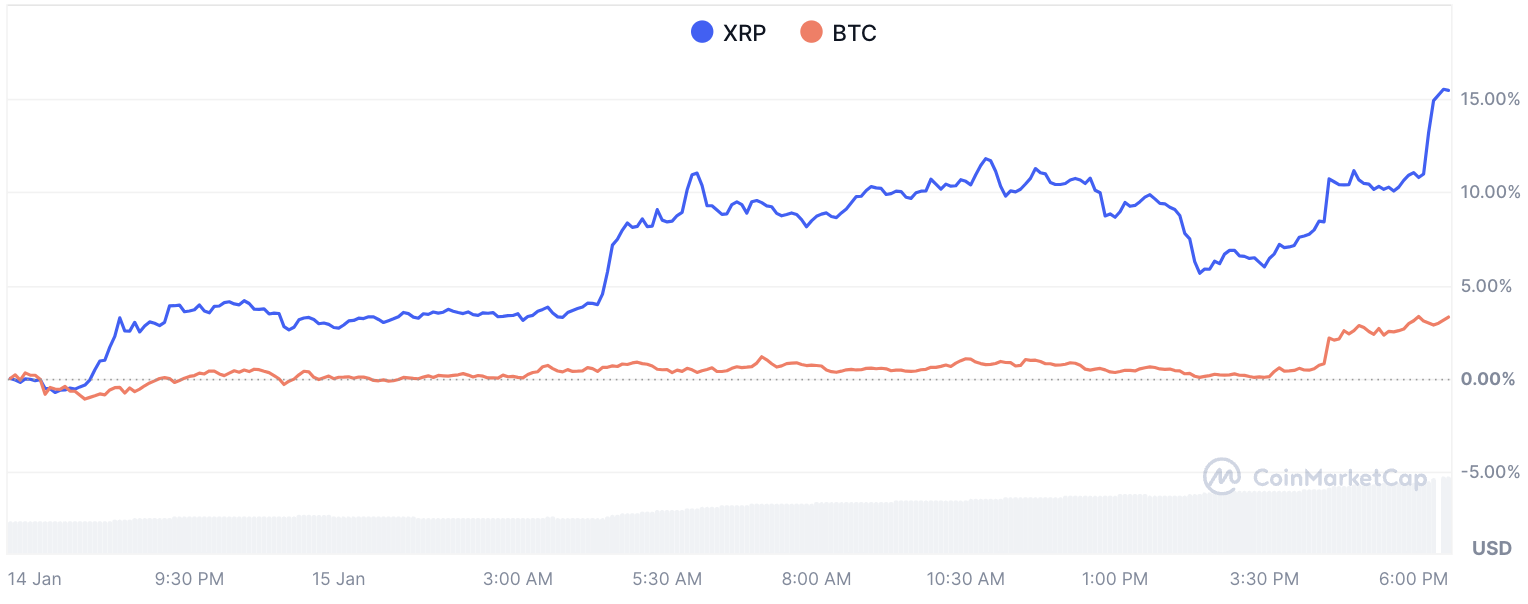

Markets, both traditional and crypto, received the news positively. What a move it was, as the price of Bitcoin actually rose by more than 2% in a matter of minutes.

Other popular cryptocurrencies such as XRP Show even crazier dynamics, with a 3.5% increase in 1 minute. We are talking about assets worth billions of dollars, and such a rapid change in prices is not even worth millions of dollars, but billions of dollars, so it is more like an earthquake.

For a specific group of investors — sellers, or bears, as they are also called — it was more or less like that.

Crushed Bears: What's next?

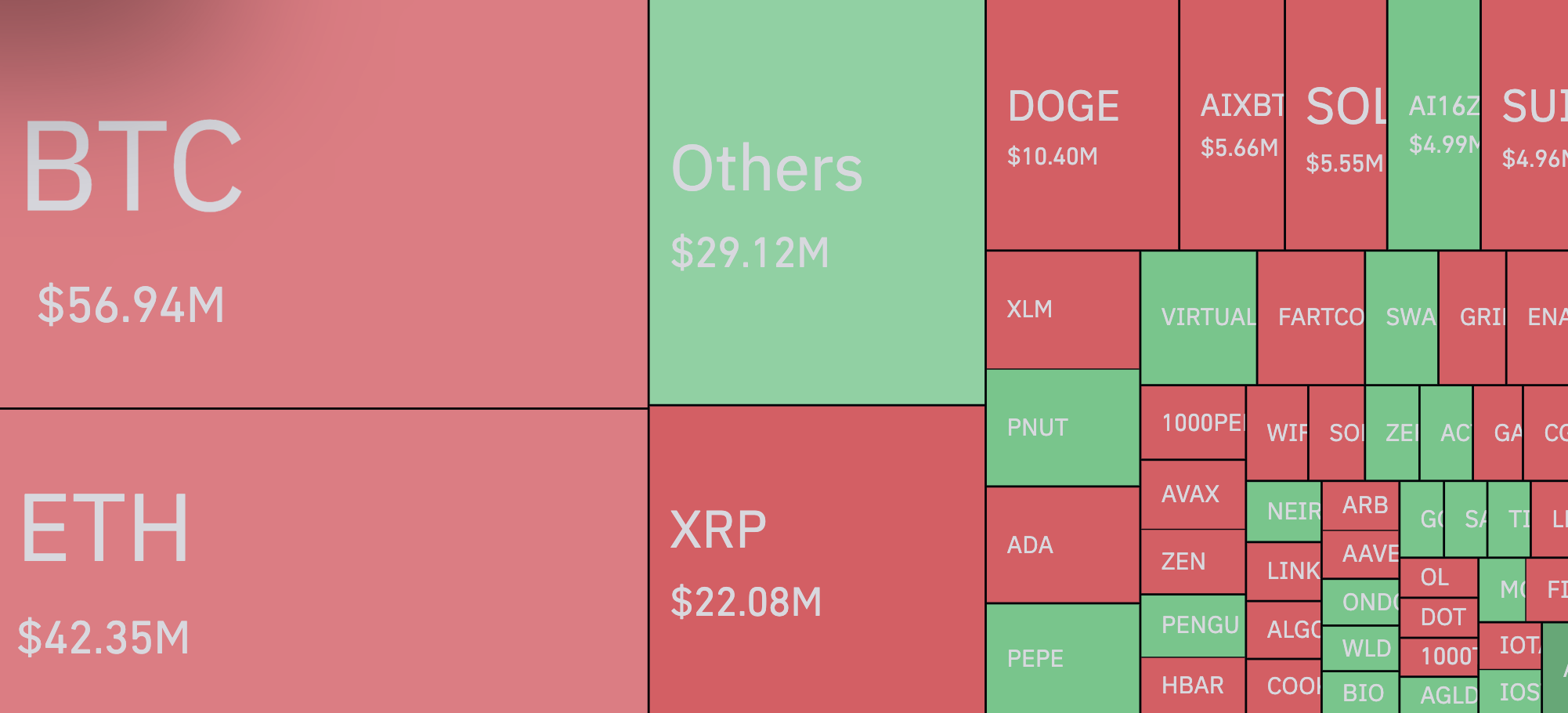

As it became known thanks to data from Queen GlassThe total volume of short positions liquidated since the release of the CPI reached $87.23 million, which is more than three times the volume of long positions. In total, short positions were liquidated at $250 million, or a whopping quarter of a billion dollars, in just 24 hours.

What is 63% of that? Sell trades, most of which were liquidated after the CPI.

Traditionally among the best bear repellers Bitcoin And Ethereum, and this time XRP also reached the top. As the third largest cryptocurrency, XRP jumped to $2.90, with over $14 million liquidated in short trades alone. To put that into perspective, Bitcoin made $39 million, and Ethereum made $28 million.

It remains to be seen where the market goes from here. All the major news of January has happened, at least in terms of monetary policy. It is expected that Gary Gensler, the current head of the Securities and Exchange Commission, will resign within five days, and a change in the US administration will occur.

These developments could introduce new dynamics to cryptocurrencies like Bitcoin, Ethereum and XRP, leaving investors speculating about whether bullish or bearish trends will dominate in the coming weeks.

Source link