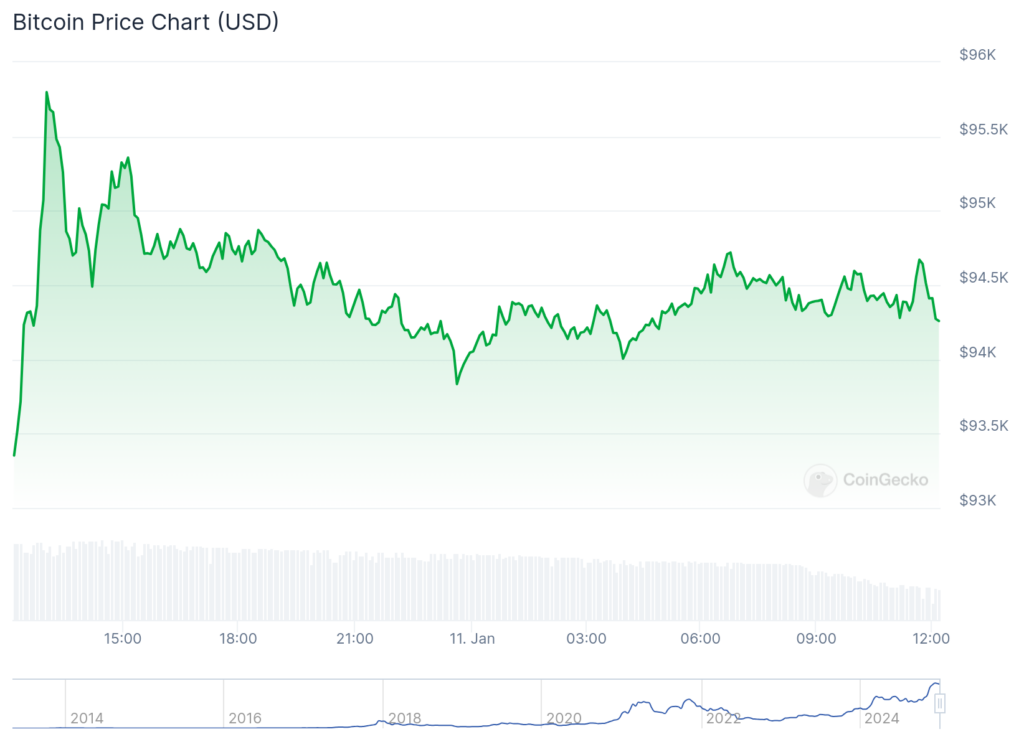

Bitcoin price remained in a tight range on Saturday as the hashrate declined, and a bearish divergence formed, threatening a bearish breakout.

Bitcoin (Bitcoin) was trading at $94,296 at last check as the market reacts to the latest report from the Bureau of Labor Statistics which shows that the US economy has created more than 256,000 job opportunities. The unemployment rate fell to 4.1%.

As a result, US stocks fell, with the Dow Jones and Nasdaq 100 falling by 697 and 317 points, respectively.

like crypto.news is expected to witness the bond market The sell-off continued, with the 30-year bond yield rising to 5.0%. Yields on 10- and 5-year bonds rose to 4.76% and 4.57%, respectively. Higher yields indicate that the market expects the Fed to maintain a hawkish tone, which typically affects risky assets like Bitcoin and altcoins.

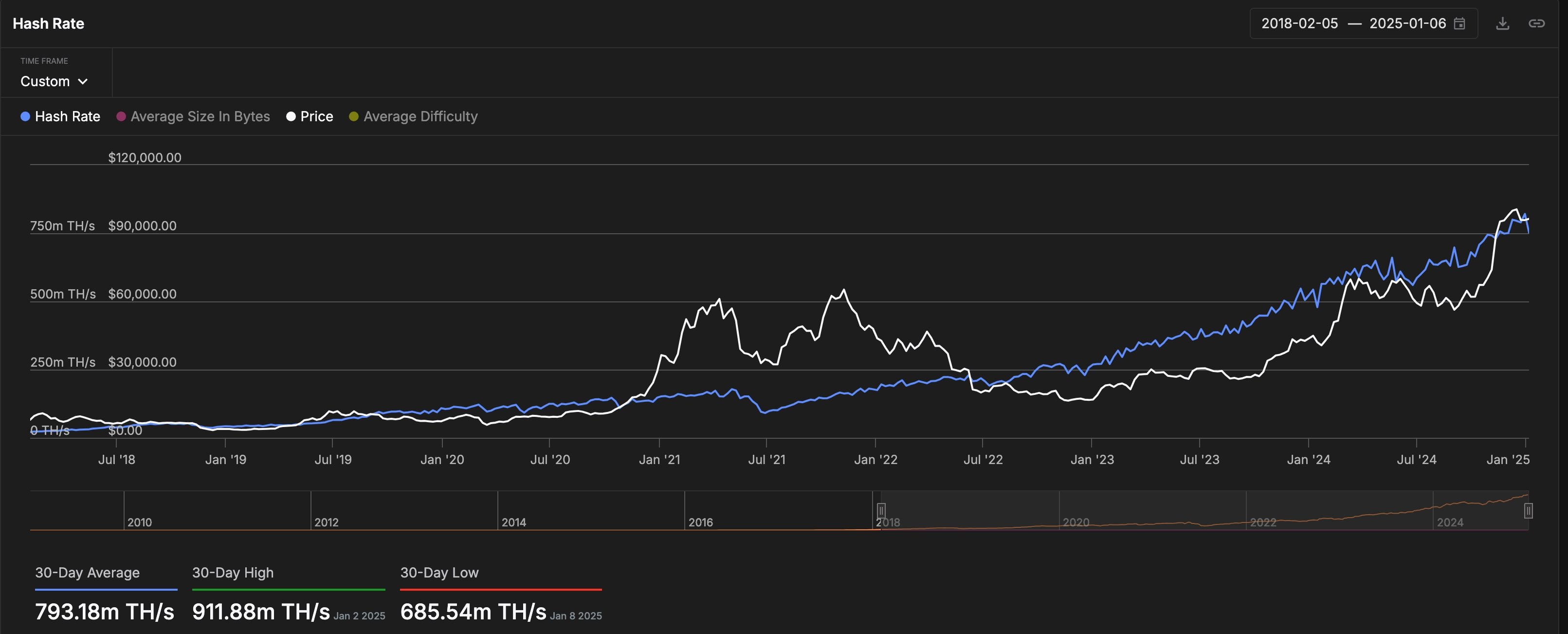

Meanwhile, data released by IntoTheBlock shows that Bitcoin's hashrate has declined in the past few days as its price has stalled.

The hash rate reached 750 THAs per second on Saturday, January 11, which is below the 30-day high of 911.88 THAs per second and the 30-day average of 793 THAs per second.

Hash rate is an important number that looks at the speed at which mathematical puzzles are solved in the network.

More on-chain data shows that the number of active Bitcoin addresses fell to 775,000 from 900,000 on Monday, a sign that some traders are starting to sell off. For example, according to SoSoValue, everything Spot Bitcoin ETFs Total outflows reached $572 million in the past two days in a row.

Bitcoin price is forming a bearish divergence

The daily chart shows that Bitcoin is at risk of a downward breakout. It has formed a risky head and shoulders chart pattern, whose neckline is at $90,952. This is one of the most common bearish patterns in trading.

Bitcoin's RSI and MACD indicators have formed a bearish divergence pattern. MACD histograms have moved below the zero line.

Therefore, a break below the H&S neckline at 90,950 risks further decline. The first support for this would be the 200-day moving average at $78,285 followed by $73,985, the highest point in March last year.

On the positive side, as we wrote earlier this week, Bitcoin price is forming a level Bullish pennant chart pattern On the weekly chart. This pattern will remain in effect as long as it exceeds $90,000.

Source link