This is part of the Forward Guidance newsletter. To read the full editions, Subscribe.

Just days into the new year, Bitcoin's price is back in the six figures.

The asset's price rose above $102,400 on Monday morning. The stock price was hovering around $101,750 at 2 pm ET - up nearly 9% from last week.

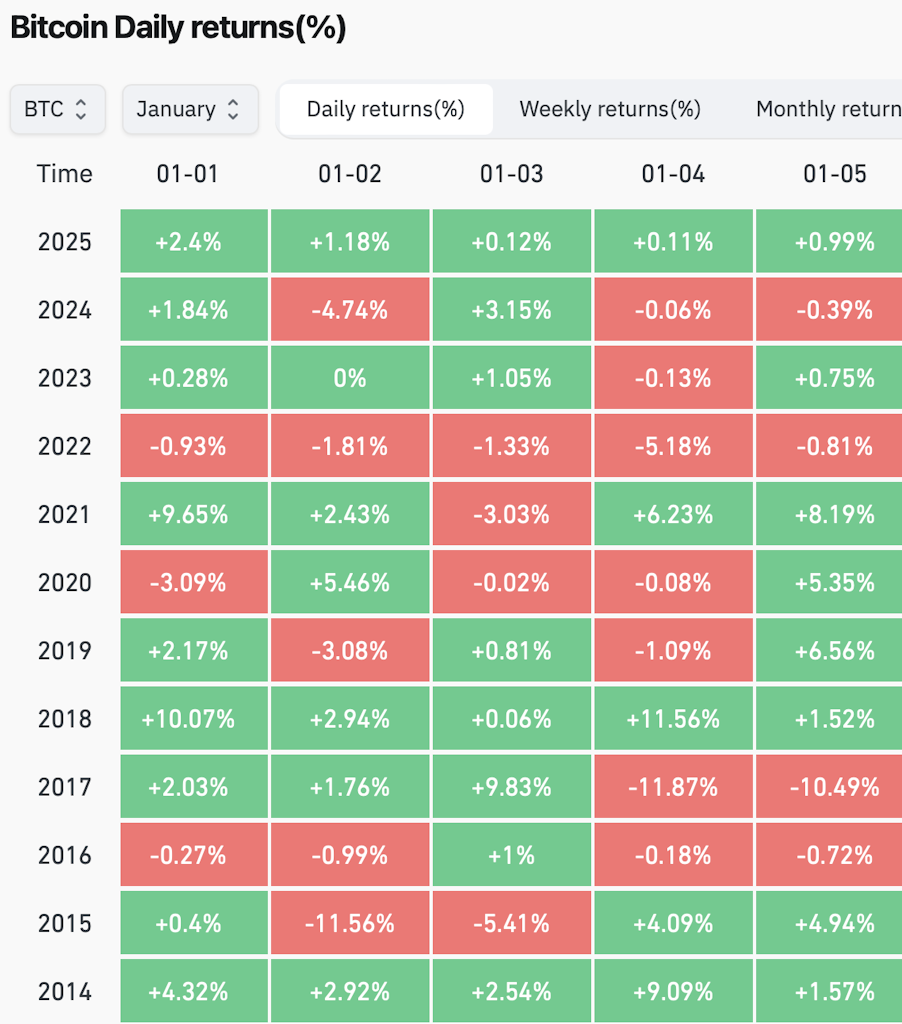

Cryptocurrencies are so far experiencing their own capabilitiesJanuary effect“—a term referring to the potential rise in stock prices during the first month of the year. CoinGlass data shows that Bitcoin saw price gains — albeit slight — during each of the first five days of the month. This has not happened since 2018.

Now you know about BTC's historic rise to an all-time high of $108,000 just over a month after Trump's remarks. Winning the elections. Then there was what some called a "Healthy" correction. Buoyed by hawkish Fed sentiment and profit-taking, with Bitcoin falling below $92,000 on December 30.

Head of Grayscale Products and Research, Rehana Sharif Al-Askari, noted Temporary withdrawals During bull markets, they are common, suggesting the FTSE/Grayscale Cryptocurrency Sector Index fell 6% in December.

“However, there is strong demand from Bitcoin exchange-traded products and US-listed Treasuries Microstrategy “It may support the price of Bitcoin,” she said when asked about it. Forecast for January.

US Bitcoin ETFs received $908 million in net new assets on Friday — rebounding from $940 million in outflows over the previous four trading days, according to Farside Investors. Data He appears.

96% of financial advisors Surveyed By Bitwise received a cryptocurrency-related question from clients in 2024. This result is consistent with the ongoing expectations fueled by the wealth manager. Capital flow In the crypto sector.

As for Sharif Askari's mention of treasury bonds, MicroStrategy's last Bitcoin purchase (Dec. 30-31) amounted to 1,070 BTC for approximately $100 million. Although smaller than its Bitcoin purchases in previous weeks, the company also just revealed it is targeting a $2 billion capital raise through perpetual preferred stock offerings to acquire more Bitcoin.

In this regard, only Metaplanet CEO Simon Jerovic male His company plans to increase its bitcoin holdings (currently 1,762 bitcoins) to 10,000 bitcoins in 2025. Then there's KULR Technology Group, which said Monday it has purchased an additional $21 million worth of bitcoin.

January, of course, is also scheduled to be Trump's inauguration. And with members 119th Congress The president-elect was sworn in last week, and hearings are underway on the president-elect's government nominees is expected to start almost.

Sherif Askari told me that the events of the confirmation hearing, and subsequent signals about the pace and extent of future regulatory clarity for cryptocurrencies, could influence the price of Bitcoin over the course of the month.

“Delays or restrictive policy announcements could dampen sentiment,” she said, before adding: “Macro factors – including the Fed’s signals on... Interest rates Market responses to a stronger US dollar could also play a role.

Start your day with the best cryptocurrency insights from David Kanellis and Katherine Ross. Subscribe to the Empire Newsletter.

Explore the growing intersection between cryptocurrencies, macroeconomics, politics, and finance with Ben Strack, Casey Wagner, and Felix Goffin. Subscribe to the Forward Way Newsletter.

Get alpha straight to your inbox with 0xResearch Newsletter — Market highlights, charts, trading ideas, management updates, and more.

The Lightspeed Newsletter has everything Solana, in your inbox every day. Subscribe to Solana Daily News By Jack Kopenick and Jeff Albus.

Source link