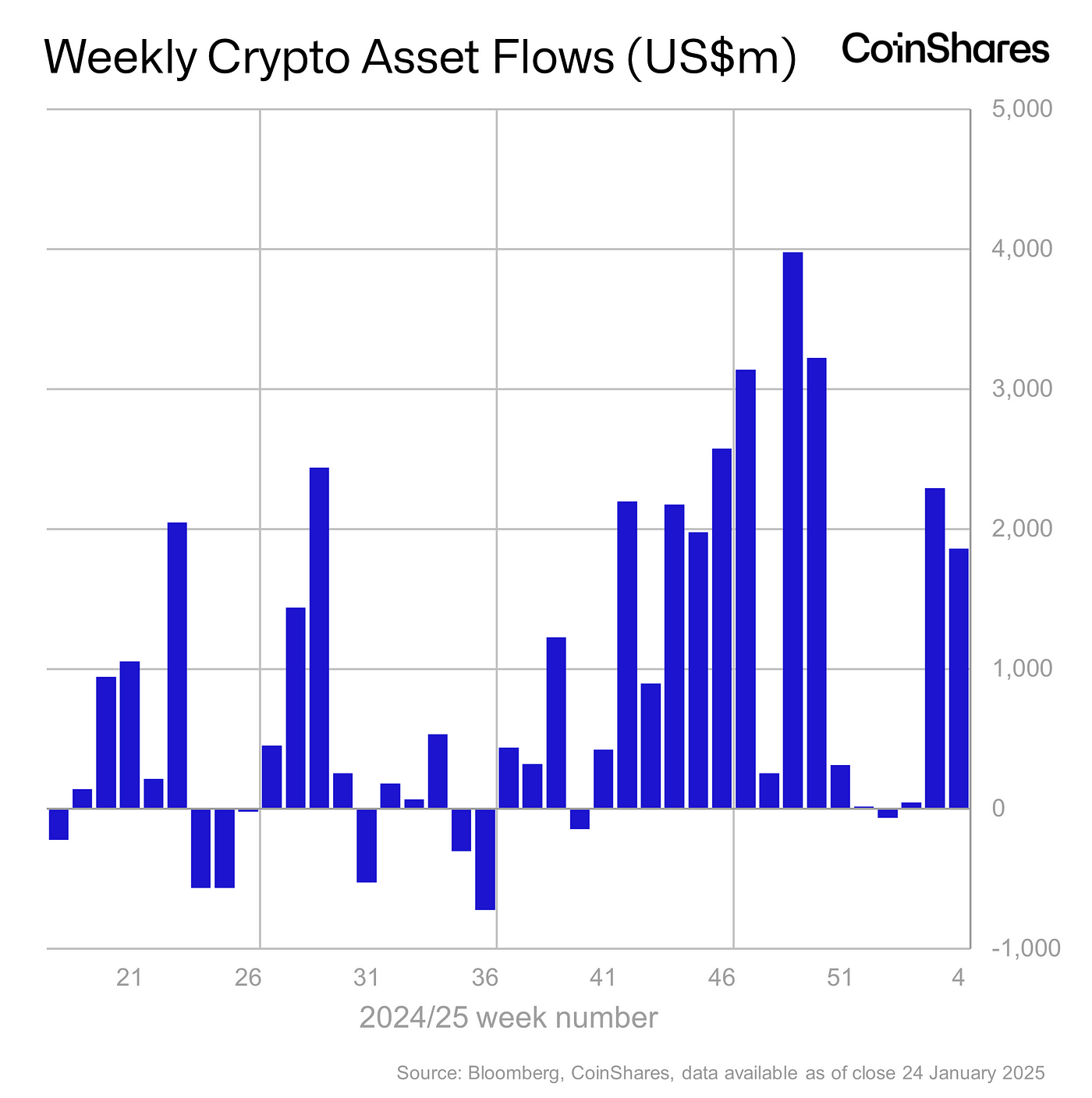

Weekly inflows into cryptocurrency ETF products reached $1.9 billion, following Trump's support for Bitcoin reserve proposals.

Nearly $2 billion USD flowed into cryptocurrency investment products last week, bringing year-to-date inflows to $4.8 billion, Currency stocks It was revealed on January 27 Research report.

Bitcoin (BitcoinThese flows remain dominant, generating $1.6 billion last week, or 92% of total flows. To date, it has attracted investments worth $4.4 billion. Short Bitcoin ETFs also saw inflows of $5.1 million, CoinShares noted, adding that this inflow was likely from traders bracing for potential market pullbacks following Bitcoin's recent rally.

The United States topped the flow, amounting to $1.7 billion. Canada received $31 million, while Switzerland and Germany received $35 million and $23 million, respectively, according to the data.

Ethereum (Ethereum) with inflows of $205 million after a difficult start to the year. ripple (XRP) raised $18.5 million, maintaining its momentum to hit New all-time high last week. As for smaller altcoins, Solana (Sol(brought in $6.9 million, Chainlink)connection(Saw $6.6 million, Polkadot)a point) added $2.6 million. James Butterville, head of research at CoinShares, noted a surprising development as “no digital asset investment products saw outflows last week.”

The increase in flows comes shortly after trading volume on centralized exchanges rose to $25 billion, accounting for 37% of activity on trusted cryptocurrency exchanges. Butterville described the latest developments as one of the most important weeks in recent memory, driven by excitement surrounding Bitcoin's potential as a strategic reserve asset.

There is still debate about how smoothly Bitcoin can be adopted as a reserve asset. In late January, Pierre Rochard, Vice President of Riot Platforms, accused Ripple has led a major lobbying campaign against the Bitcoin Strategic Reserve, claiming that the company is spending millions trying to block it.

Roshard said Ripple continues to defend its XRP narrative and push for state-backed digital currencies. He also noted that Ripple previously targeted Bitcoin mining under the Biden administration. Despite this, Ripple CEO Brad Garlinghouse quickly responded, noting that the company's efforts align with the broader goals of the Biden administration.

Source link