“Next year will really show ordinary people what cryptocurrencies are for,” Bruno Caratore, co-founder of Hashdex, told me confidently last week.

And no, he didn't just mean Bitcoin. He added that next year could be “the dawn of an era of cryptocurrencies beyond Bitcoin.”

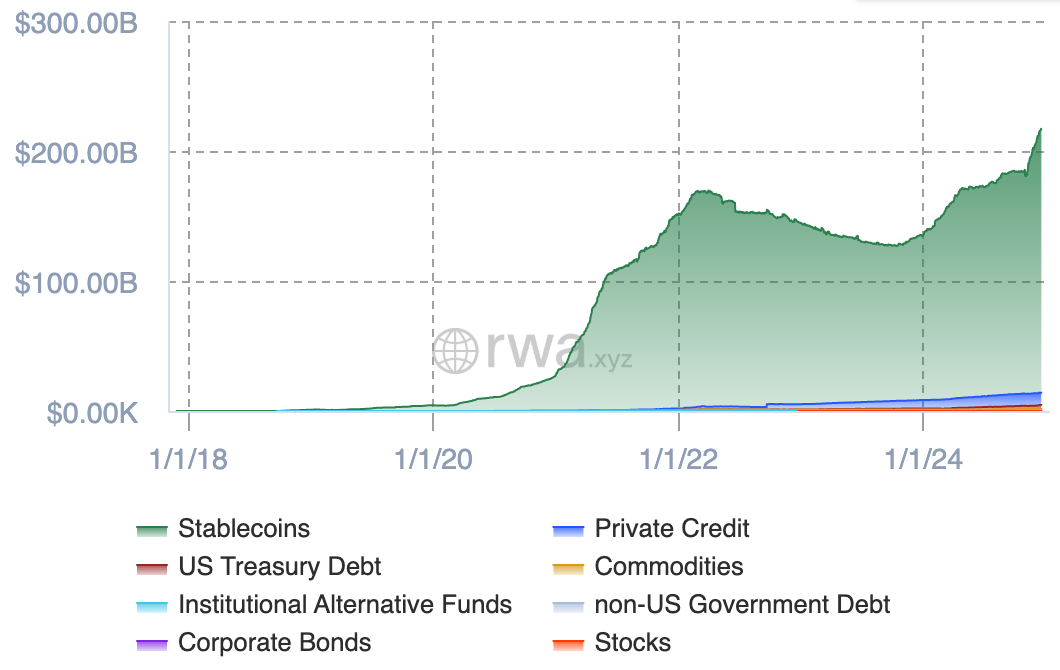

Much of Caratore's thinking comes from the fact that stablecoins have seen such a breakthrough into mainstream interest, as have a lot of real-world asset offerings (if you include stablecoins in the mix, though I'm not sure David would ). .

The total onchain RWA is approximately $14 billion, with a stablecoin value exceeding $200 billion.

Caratore noted that stablecoins have the upper hand because they are “easy enough” to understand.

If you ask Caratore for some predictions — dear reader, I might as well do that — he'll tell you he thinks we could see “daily transactions” in the US using stablecoins starting next year.

Part of this is because Circle could potentially hit the public markets in 2025. If you remember, we recently talked about What a Circle IPO could look like.

If we see them enter the public stage, it will be “the most significant crypto IPO since Coinbase.”

“This is the player that will get a lot of exposure. First of all, they will get the resources to invest in the ecosystem. Even what they have been doing so far, initiatives like the merger into Stripe could be the main gateway for online commerce,” he explained. With) initiatives like this, they will be better resourced not only with money, but also with the credibility that comes with establishing relationships.

If we see adoption across cryptocurrencies, Caratori believes we could see the end of the boom-bust cycle. Controversial, I know.

“There is a broad consensus in the crypto space that they are behaving in this four-year cycle, and they have been that way forever, and they will continue to be that way. 2025 will be a year of exuberance, inevitably followed by a massive 70% to 80% decline. I see how this has been.” True before (but) I think real adoption by governments, by big players — like the BlackRocks of the world — (is stabilizing cryptocurrencies).”

“So I don't expect this to be a lot of activity and then a recession cycle after that and again. The first applications will become real to the public,” Caratore said.

Start your day with the best cryptocurrency insights from David Kanellis and Katherine Ross. Subscribe to the Empire Newsletter.

Explore the growing intersection between cryptocurrencies, macroeconomics, politics, and finance with Ben Strack, Casey Wagner, and Felix Goffin. Subscribe to the Forward Way Newsletter.

Get alpha straight to your inbox with 0xResearch Newsletter - Market highlights, charts, trade ideas, management updates, and more.

The Lightspeed Newsletter has everything Solana, in your inbox every day. Subscribe to Solana Daily News By Jack Kopenick and Jeff Albus.

Source link