The price of Litecoin remained volatile over the weekend, mirroring the performance of Bitcoin, which remained below $95,000.

litecoin (ltc), a popular proof-of-work coin, is stuck at $103.03, down 30% from its 2024 high. This decline is in line with most cryptocurrencies, which pared some of the gains they made last year.

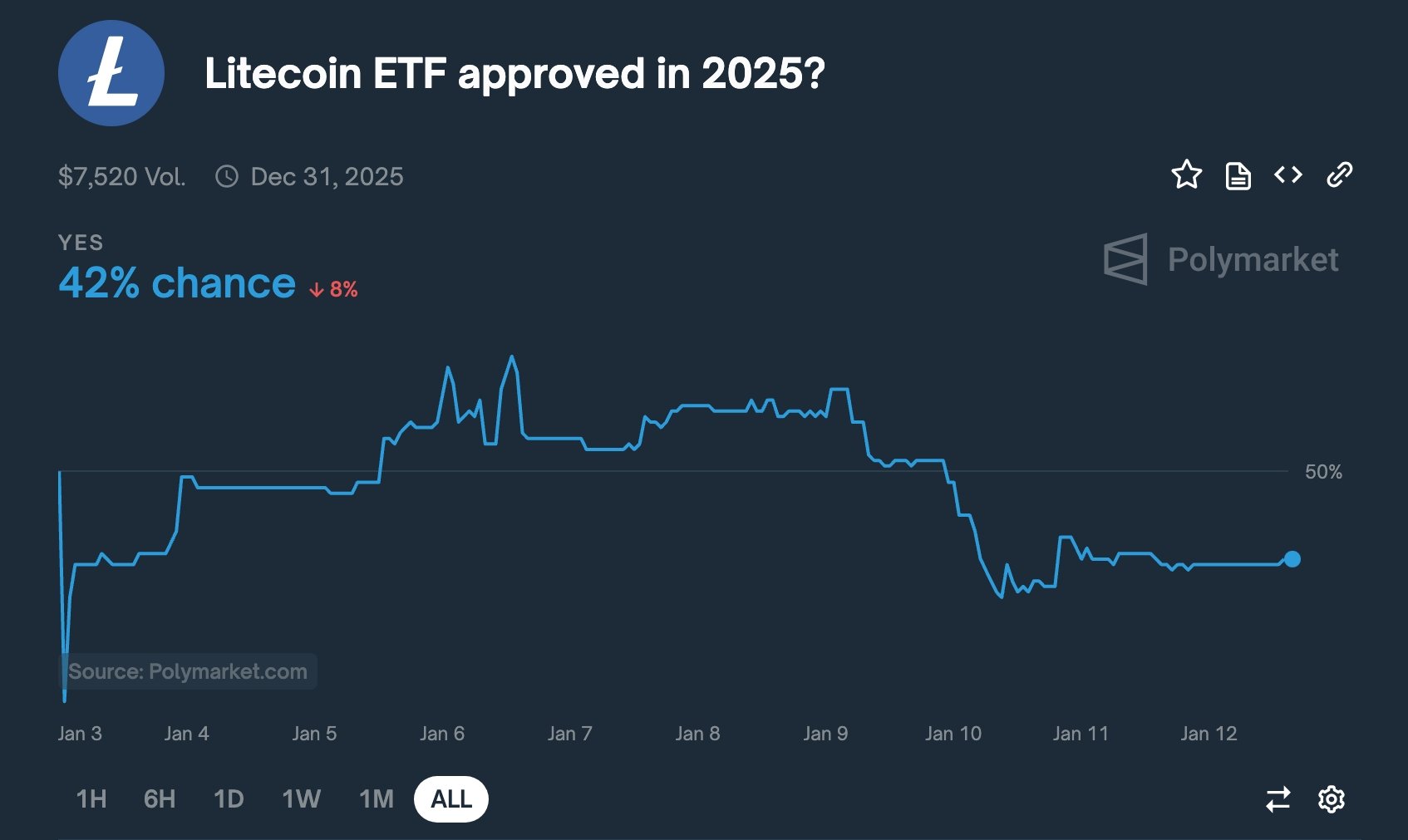

Litecoin's performance was also driven by lower odds of the SEC approving a spot LTC ETF in 2025. According to Polymarket, these odds have fallen to 42% from this year's high of 60%.

Eric Balchunas, a senior ETF analyst at Bloomberg, promoted the view that the SEC would approve a spot LTC ETF. In a post in December, he said the agency would readily approve a Litecoin fund because it is bitcoin (Bitcoin) Hard fork.

Canary Capital is the only company to apply for the Litecoin Spot ETF. Grayscale may also apply to turn the Litecoin Trust, which has more than $215 million in assets, into an exchange-traded fund as it has done with Bitcoin and Ethereum.

While a Litecoin exchange-traded fund would be a good thing for the currency, it is unclear whether it would gain interest from institutional investors. A good example of this is the performance of Bitcoin and Ethereum ETFs. Bitcoin funds have more than $107 billion in assets, 5.7% of the total market capitalization. Ethereum funds hold $11.6 billion, 2.96% of market capitalization, indicating that institutional demand is weak.

Interest in Litecoin will be weaker than Ethereum since it is a smaller cryptocurrency project with a market cap of $7.7 billion. It has also lost market share in the cryptocurrency industry as its ranking has moved to 22nd after being in the top 10 a few years ago.

Polymarket traders are optimistic that the SEC will approve Solana (Sol) and Ripple ETFs (XRP). this year. Odds of Agency Approval of Spot XRP ETF It is 70%while Solana ETFs accounted for 73%. These funds may have a chance of succeeding given their market capitalizations of $144 billion and $67 billion, respectively.

Source link