Bitcoin Development Company Strategy The company bought the summit - again - and spent more than a billion dollars on the largest encrypted currency before it fell on Monday.

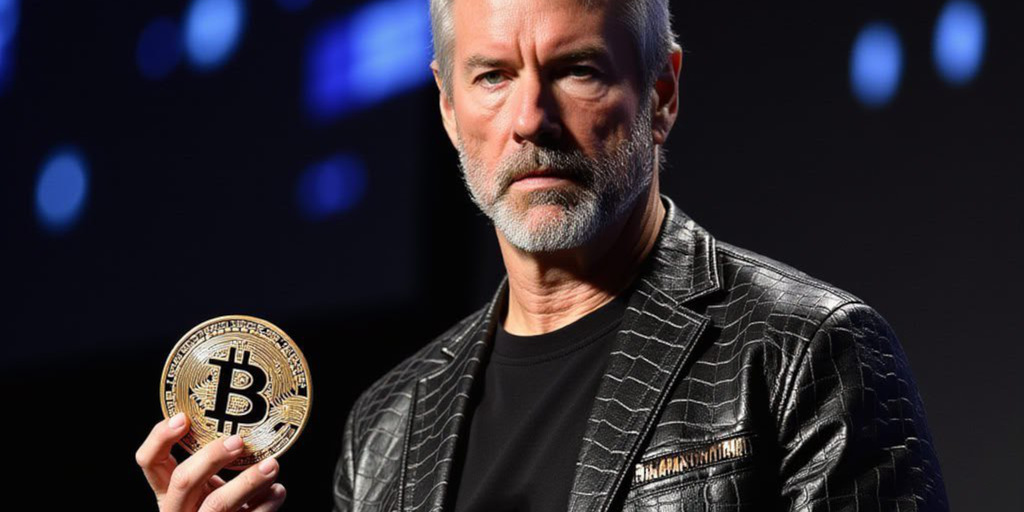

Bitcoin preacher in the company, co -founder and CEO Michael Sailor, He said On Monday that the company spent about $ 1.1 billion to buy 10,107 bitcoin currencies at an average price of 105,596 dollars per currency during the past week.

Bitcoin is now trading about $ 100,700 after that He decreased to a low level of up to 98,380 dollars On Monday morning, New York time, according to Coingecko.

Microstrategy now has 471,107 bitcoin coins - currently estimated at more than $ 47 billion. Silor said on X (previously Twitter) that the company spent a total of 30.4 billion dollars on the encrypted currency, with an average price of $ 64,511 per bitcoin.

After Microstrategy was a sleeping software company, it has now become the city's talk: the company's market value has increased dramatically, which has achieved huge gains for shareholders since the company adopted the Bitcoin strategy.

It works to give investors what it calls safe and organized exposure to bitcoin through its shares, which are traded on the Nasdaq Stock Exchange.

The company bought Bitcoin for the first time in 2020 and has not stopped since then - although it has accelerated the purchase over the past 12 weeks, announcing a new purchase every week during that period.

Silor believes that bitcoin is the best way to hedge from inflation and a way to keep wealth in the long run, and other companies urge to follow their example.

The company is in December join Nasdaq 100, an indicator of the 100 largest non -financial companies in the stock market in NASDAC, guarantees its position with some of the most valuable companies in the world - such as Apple and Microsoft.

Microstrategy (NASDAQ: MSTR) is currently about 340 dollars per share, a decrease of 14 % during the past week and about 4 % so far on Monday amid a wider decrease in the stock market apparently due The appearance of the Chinese artificial intelligence model Deepseek.

Modified by Andrew Hayouard

Extract daily information Newsletter

Start every day with the latest news, as well as original features, podcasts, videos and more.