Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

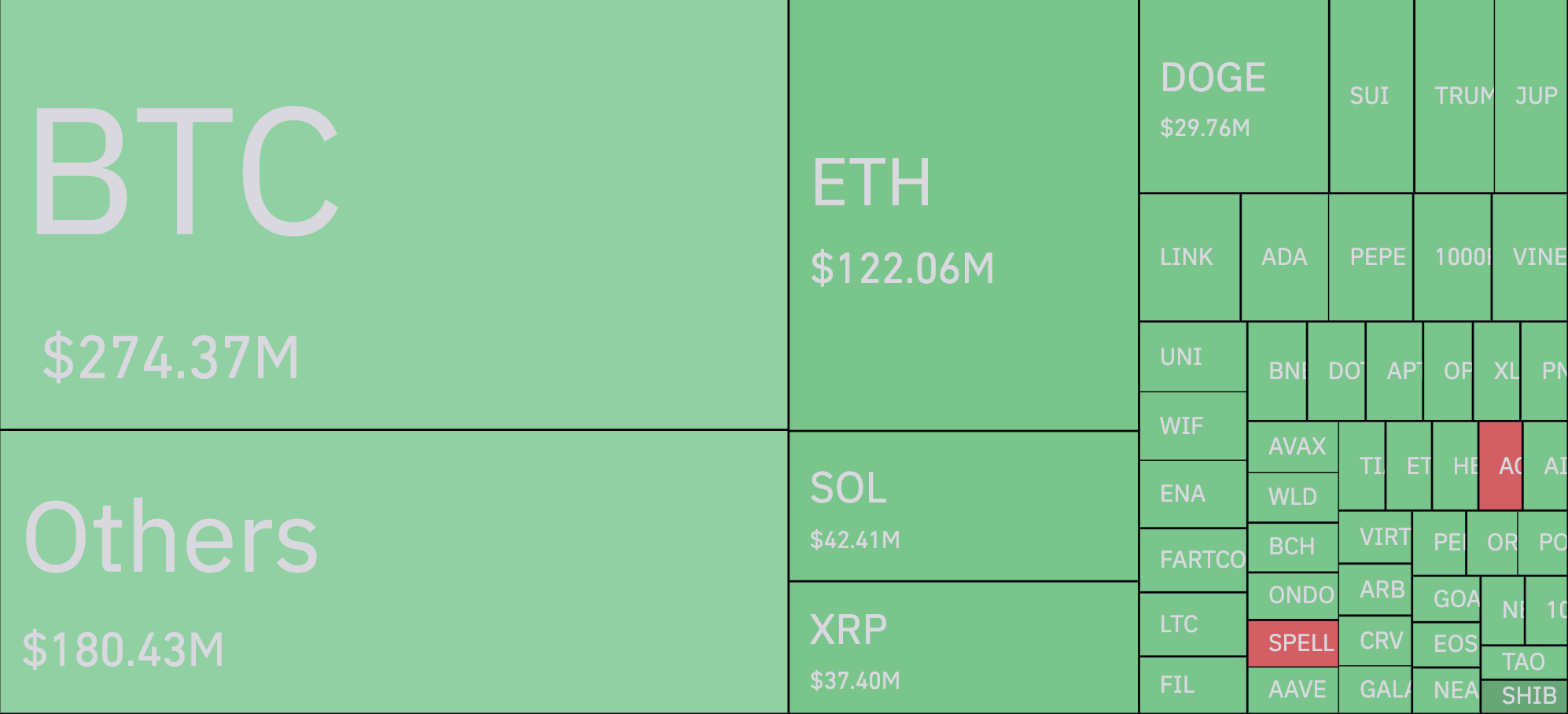

The last few days, especially the last few hours, in the cryptocurrency market have been very bleak and painful, with liquidations in margin positions totaling $880 million. The majority of this amount is of course long bets, which amounted to $808.74 million, or 91.8% of the total. Painful, especially for bulls.

The biggest hit ever taken BitcoinOf course, as the leading cryptocurrency, with the imbalance between long and short liquidation in the perpetual futures market rising to 1,680%. Imagine, just $15 million worth of shorts Bitcoin They were liquidated within the last 24 hours.

Amid this bloodbath, most market participants have turned to price charts and what key opinion leaders are saying about currency market speculation.

One such is Raoul Paladvocate of the "Banana Zone", a concept that attracted many in this cycle and gained fame throughout the space. In Pal's opinion, what is happening now is nothing more than "noise."

What's the noise?

Pal's talk can be attributed to the emergence of Deepseek, a new competitor to ChatGPT, but from China. The fact that this artificial intelligence The chatbot was able to do the same task, but at 20 times less cost, wreaking massive havoc on the AI sector of the traditional stock market, causing Nvidia shares and the Nasdaq stock market as a whole to collapse.

According to the general opinion, this is what led to the recent collapse of the cryptocurrency market, and according to Pal, this is nothing more than hype that will in no way prevent the rise in prices of crypto assets in the medium and long term.

The recipe for managing the situation so far, according to Pal, is very simple: keep calm and buy sauce. Oh, and don't screw it up, warns an experienced trader.

Source link