Sui extends its 4% gain on Friday, after rising nearly 14% this week. Uniswap begins recovery on Friday after losing nearly 8% in value on the weekly time frame. The two tokens could offer higher gains to their holders in the coming week.

Bitcoin looks to recover, and Sui and Uniswap may rise in tandem

Bitcoin (Bitcoin) has lost nearly 3% of its value this week, and the largest cryptocurrency begins to recover on Friday. At the time of writing, Bitcoin posted gains of nearly 3% on the day, hovering above $94,000.

As Bitcoin looks to recover, altcoins Sui and Uniswap show potential for gains in the coming week. SUI can extend its height and climb higher. Uniswap is currently erasing last week's losses, with UNI adding nearly 4% value on Friday.

but and UNI It trades at $5.0865 and $13,371 at the time of writing.

Technical and financial indicators support the gains

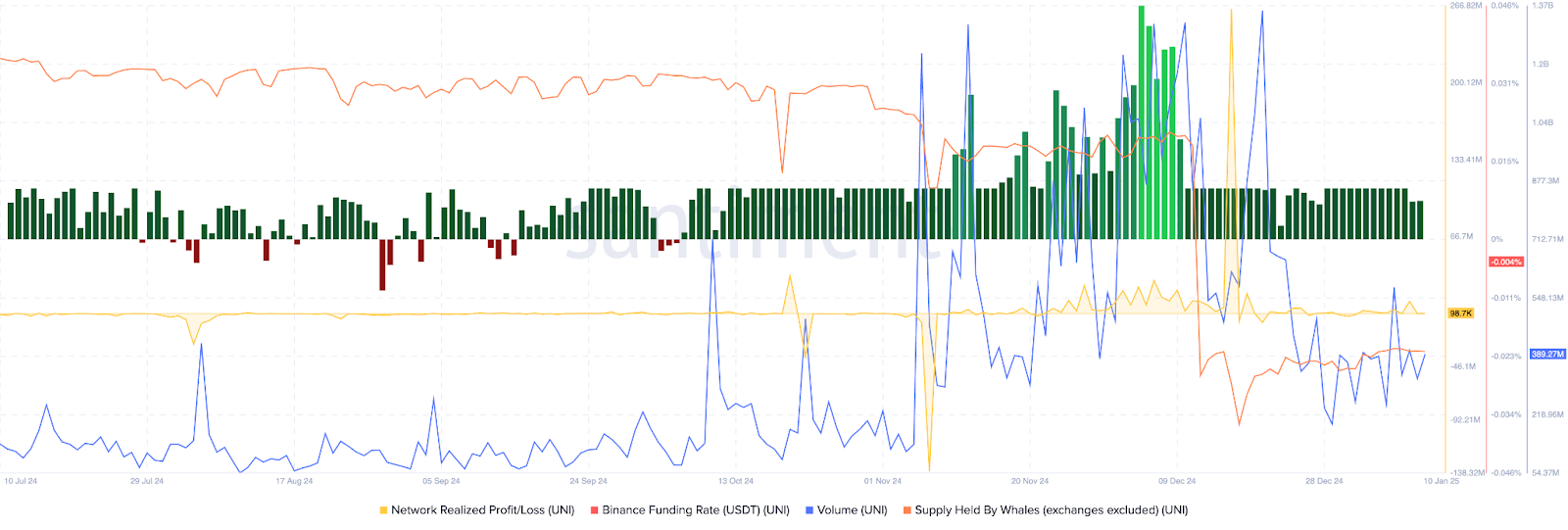

On-chain Uniswap indicators support the bullish thesis for the DeFi token. The network's P/E metric shows a slowdown in profit taking by UNI token holders in the past two weeks. Typically, as profit taking slows down, it reduces the selling pressure on the token.

Volume is on an upward trend, between December 28 and January 10. Rising volume combined with an increase in price leads to gains in the token.

The supply of UNI token held by large wallet investors has been rising continuously since mid-December. This supply represents UNI held outside of exchange portfolios, so the rise in these holdings is not contributing to selling pressure. It is a sign of growing investor confidence in UNI.

Binance's funding rate has been consistently positive for about a month, supporting the bullish thesis for UNI price.

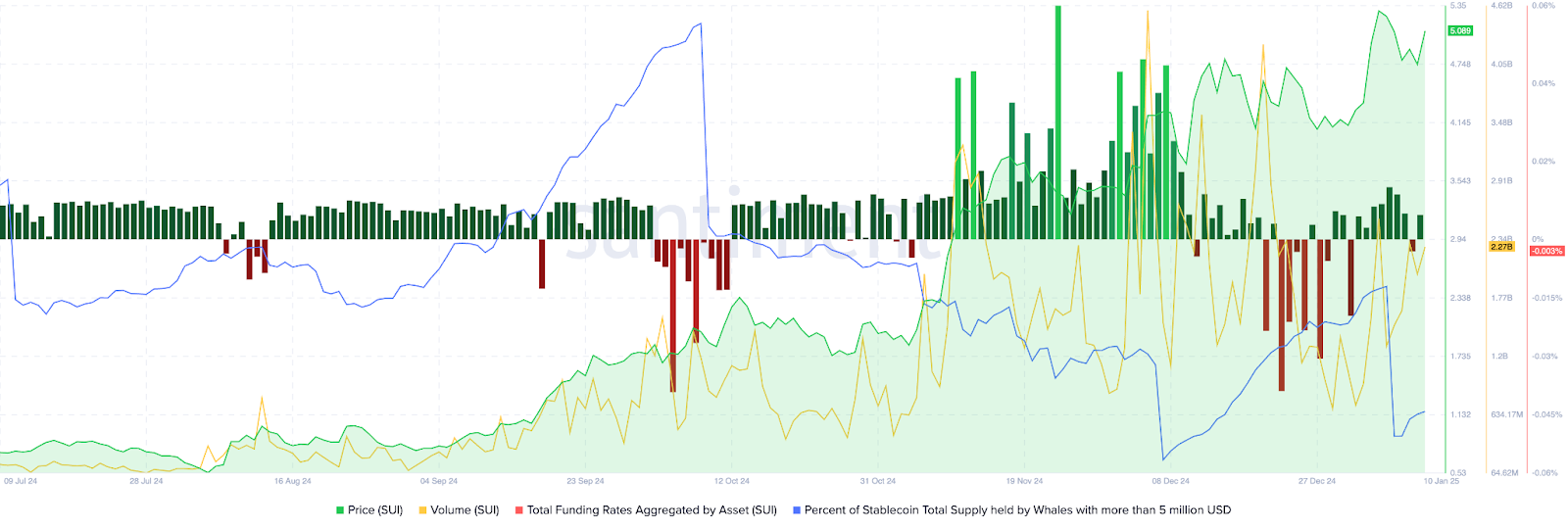

but Trade volume is on an upward trend with long positive spikes between December 27th and January 10th. In the same time frame, SUI syndicated funding rates became positive across major exchanges and the price rose.

The percentage of total stablecoin supply held by whales has risen by more than $5 million in the past three days, demonstrating increased demand for the token across exchanges.

What to expect from SUI and UNI next week

UNI The price is consolidating near $13.05, which is the 50% Fibonacci retracement level of the rise from $6,640 to $19,459. A key technical indicator, the Relative Strength Index supports further gains in UNI.

The Relative Strength Index is sloping upward and reading 44, near neutral.

Traders need to keep their eyes open as the Moving Average Convergence Divergence indicator is flashing red histogram bars below the neutral line, which means there is underlying negative momentum in the UNI price direction.

If UNI extends its gains, the DeFi token could target a January 6 high of $15,595. UNI could test resistance at $15,595, representing a 17% increase in the price of the token.

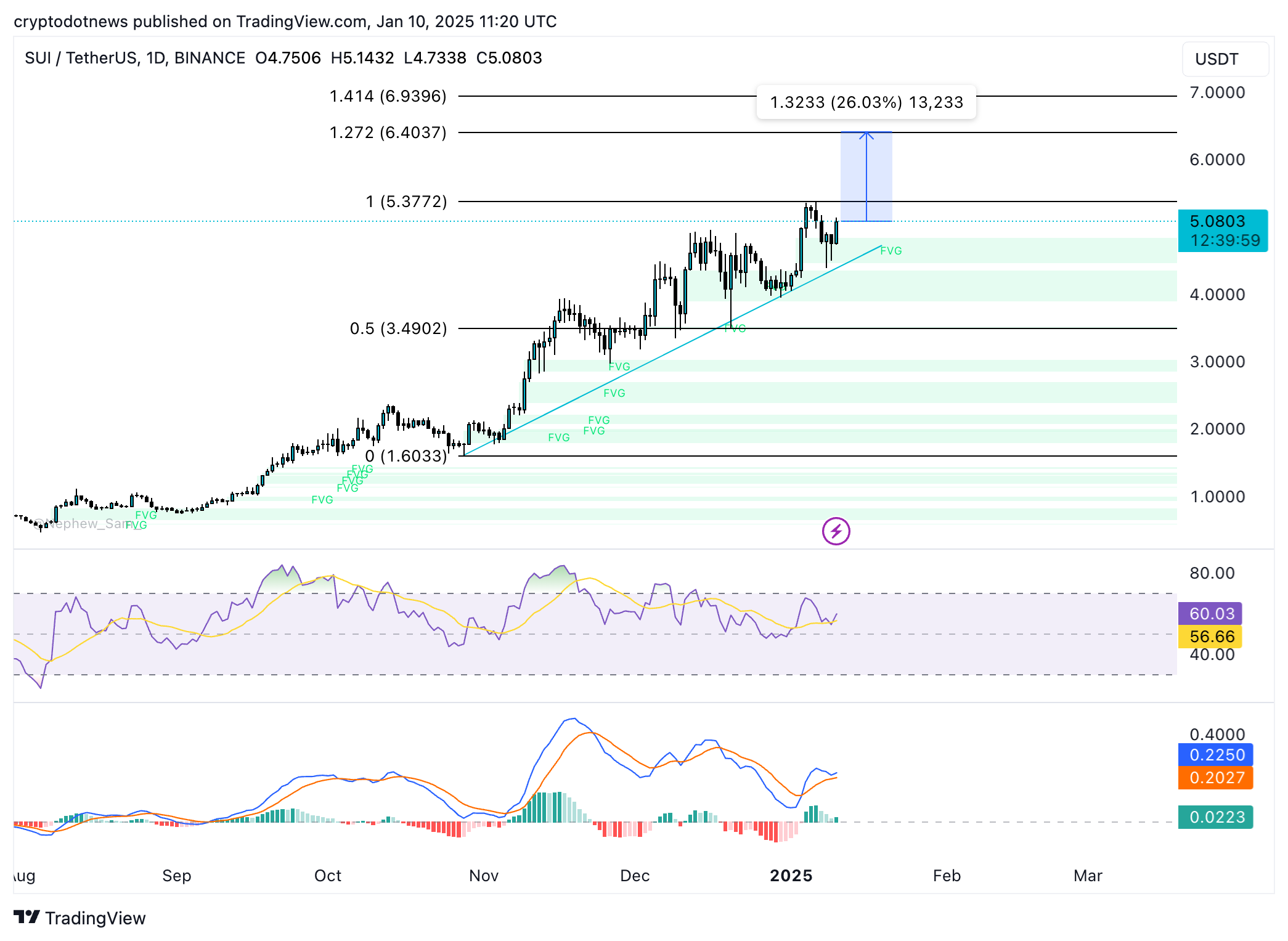

SUI is on an upward trend that started in November 2024. The layer 1 blockchain token is approaching its peak of $5.3772. SUI could continue its uptrend and rise towards the 127.2% Fibonacci retracement level at $6.4037.

SUI could rise 26% and test resistance at $6.4037.

The RSI and MACD support a bullish hypothesis for the first layer symbol, and the RSI is sloping upward and reading 60. The MACD is showing green histogram bars above the neutral line, indicating that positive momentum is the underlying SUI price trend.

State of the crypto market

David Morrison, chief market analyst at Trade Nation, told Crypto.news in an exclusive interview:

“Bitcoin looks more active this morning and has recouped most of yesterday's losses.”

In a deep dive into the market, analysts at Crypto Finance noted the following:

“BTC faced another headwind this week as the US Department of Justice announced its approval of the liquidation of 69,000 BTC seized from Silk Road. This potential sell-off worth around $6.5 billion appears to have spooked traders and eliminated the weaker hands. Why It Matters This?DoJ's BTC holdings represent a significant portion of total market liquidity and in an already unstable macro environment, this news added fuel to the fire.

Despite this, Bitcoin held key support at around $92,000, but a break below this level could pave the way for a deeper pullback.

The 24-hour liquidation value in the cryptocurrency market exceeded $329 million on Friday. Of this, Bitcoin accounts for over $88 million in liquidations with the largest cryptocurrency consolidated. Traders should closely monitor liquidations next week to determine if the market improves and makes room for increased demand for cryptocurrencies.

Reason for optimism as regulatory outlook improves in the US

Elliptic's David Carlisle explores cryptocurrency policy and regulation in his latest paper at Elliptic. Carlisle points out that 2024 was a year of significant developments that will have an impact on the cryptocurrency space for years to come.

Carlisle believes that in 2025, cryptocurrency policy and regulation can make great strides. In the United States, banking regulators could lower barriers to dealing with cryptocurrencies for financial institutions, and the presidency of President-elect Donald Trump could boost pro-crypto sentiment.

Key appointments such as SEC Chairman, AI and Cryptocurrency Czar, and CFTC Chairman by the next president could impact the regulatory and policy approach to cryptocurrencies in the United States.

Ripple CEO Brad Garlinghouse recently revealed that 75% of the company's open jobs are now located in the US, and cited the "Trump effect" as the motivation behind the company's decision. Growing optimism among cryptocurrency companies and a favorable regulatory environment could support demand for cryptocurrencies among US-based traders.

Disclosure: This article does not constitute investment advice. The content and materials contained on this page are for educational purposes only.

Source link