Disclaimer: The opinions expressed by our writers are their own and do not represent the opinions of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

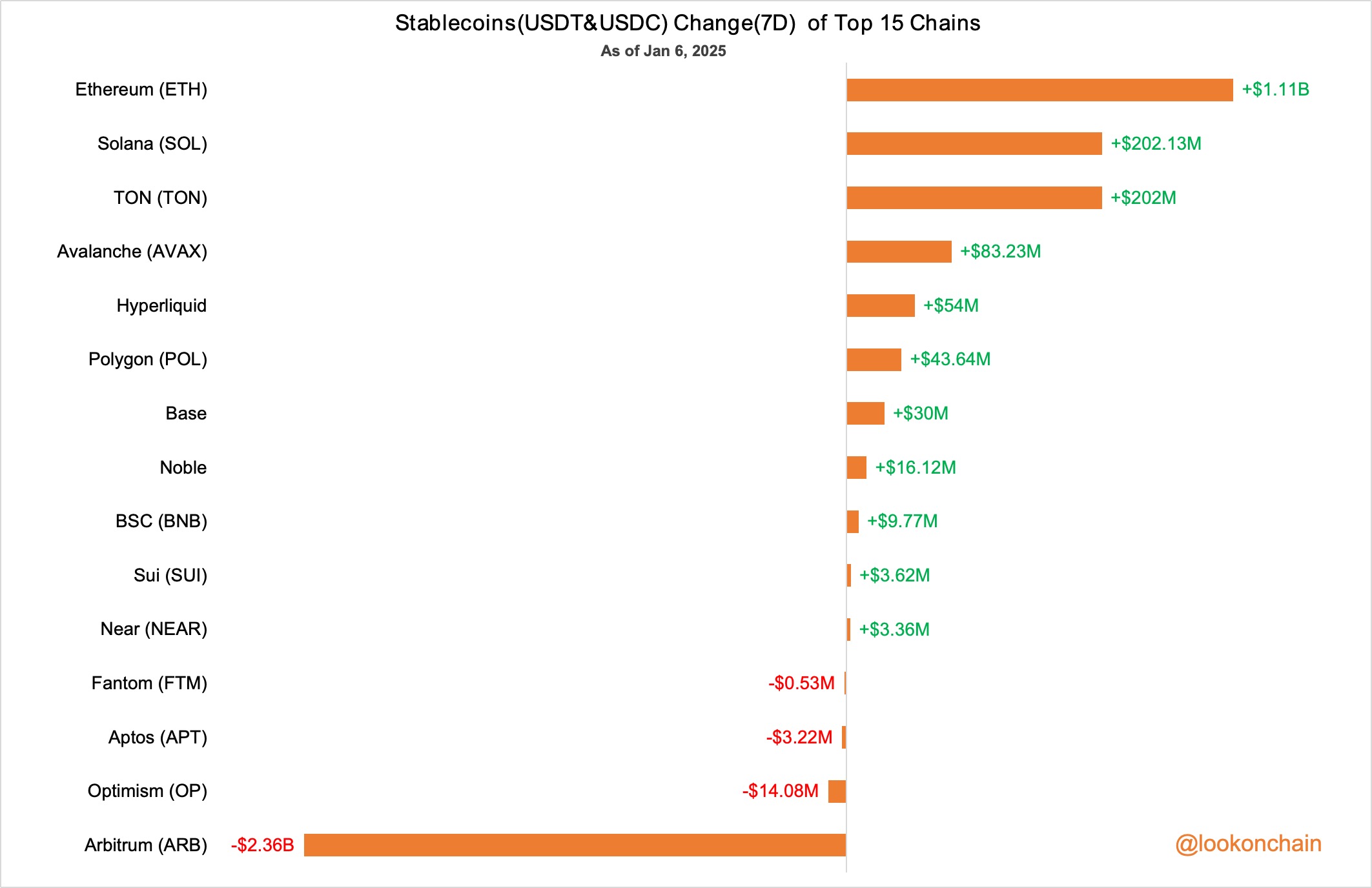

The inflow of Ethereum stablecoins has increased significantly at the beginning of 2025, indicating increased market activity on its network. Stablecoins on Ethereumlike USDT and USDC, have risen in value by a staggering $111 billion in the past seven days. Among the leading blockchain ecosystems, this is the highest, indicating strong investor confidence and activity. In contrast, Solana saw a $202.13 million increase in the stablecoin, indicating strong but relatively modest strength. growth.

A large inflow of stablecoins usually indicates increased systemic liquidity and purchasing power. In order to purchase other digital assets or engage in DeFi activities, investors often transfer stablecoins to blockchain networks. Ethereum, the most popular smart contract platform, remains the main focus for these types of movements. Meanwhile, $14.08 million worth of stablecoins have left Arbitrum, which could be a sign that liquidity is returning to the Ethereum mainnet from layer 2 solutions.

Despite the growing acceptance of alternative solutions, this pattern highlights Ethereum's superiority. This optimism is reflected in Ethereum Price chart. With a significant breakout above its major moving averages, including the 50 EMA, ETH maintains stability at $3,642. Ethereum is positioned for a potential short-term test of $4,000 based on current momentum.

However, trading volumes have not increased significantly yet, indicating that the market remains cautious. Ethereum is still not in the overbought zone, as RSI levels above 55 indicate the potential for additional growth. Ethereum's bullish momentum may continue if stablecoin inflow turns into active buying. Funds are redistributed throughout the broader cryptocurrency market Ethereum And Solana is getting attention.

This pattern suggests that investors may be moving back towards more established ecosystems at the expense of newer chains, such as Arbitrum. Inflows from stablecoins are cementing Ethereum's position as a cornerstone of the market.

As 2025 approaches, Ethereum appears poised to take the lead. A crucial indicator to watch is the $1.11 billion inflow of stablecoins, which will likely pave the way for future expansion and absorption in the coming weeks.

Source link