The price of Ethena has fallen for three consecutive days as exchange balances continue to rise and whales sell their tokens.

Athens (this) The token fell to $0.95, moving below the psychologically important level of $1 for the first time since December 20.

The reason for the continuous collapse is Risk sentiment In the cryptocurrency industry, which has cause bitcoin(Bitcoin) and other prices to be minimum.

This also happened when on-chain data showed that whales were selling their tokens. the Biggest deal This happened when a whale sent 11.6 million ENA tokens worth $11 million to Binance, the largest cryptocurrency exchange. In another transaction, a trader transferred $10.7 million worth of ENA tokens to Binance.

Athens Whales dumped $30 million worth of tokens on Thursday, December 26. These sales occurred a week after Arthur Hayes, Bitmex founder and former investor, went public. He sold some of his ENA tokens. According to Nansen, Hayes now owns 18,616 coins worth $17,458.

The price of Ethena also fell as the cryptocurrency continued to rise on exchanges, a common bearish view. These tokens have risen by 5.82% in the past seven days to over 730.27 million. The total supply on the exchanges moved to 4.87%, up 0.27% a week ago.

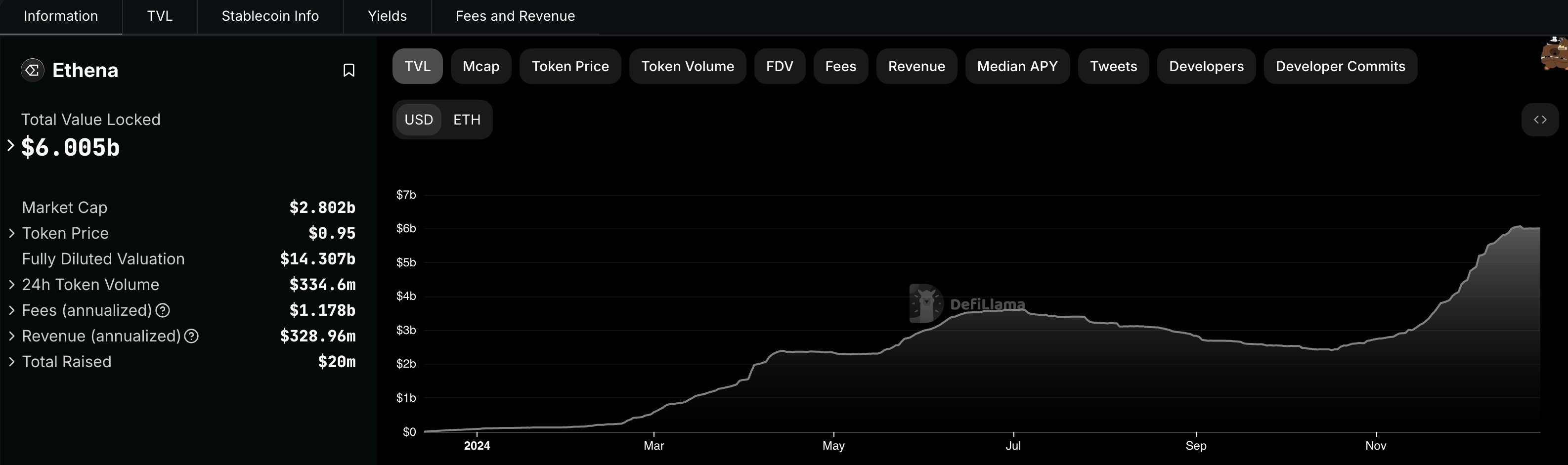

Meanwhile, inflows to Ethena's stablecoin USDe have stopped. The currency has Market value: $6 billionThe last few days have been a sign of slowing demand.

Ethena price analysis

Technicians are indicating that Ethena may have further downside, as it has formed a head and shoulders pattern on the 4-hour chart. This pattern consists of a neckline located at $0.8552, shoulders, and a head. In most periods, the pattern triggers strong downward momentum when it moves below the neckline.

Ethena also moved to the 38.2% Fibonacci retracement level and fell below the 50-period moving average. It also fell below the strong pivotal reversal of the Murrey Math Lines.

Therefore, the token is likely to continue lower, with the immediate target being the H&S neckline at $0.8552. A drop below this level would indicate further downside, potentially reaching the oversold level of $0.5860.

Disclosure: This article does not constitute investment advice. The content and materials contained on this page are for educational purposes only.

Source link