VIRTUAL is up 73% since its monthly low on January 13, with the rally accelerating after the project announced new incentives for ecosystem and community builders.

Default protocol for AI agent platform (hypothetical) to $3.98, 39% above its intraday low on January 16, while its market capitalization stands at over $3.8 billion at the time of writing. Its daily trading volume also rose by 37% and is hovering above $821 million amid increased trading activity.

Looking at its year-over-year gains, the altcoin is up nearly 37,000%, making it the best-performing asset among the 100 largest cryptocurrencies, according to data from CoinGecko.

There are three main reasons why VIRTUAL is on the rise today.

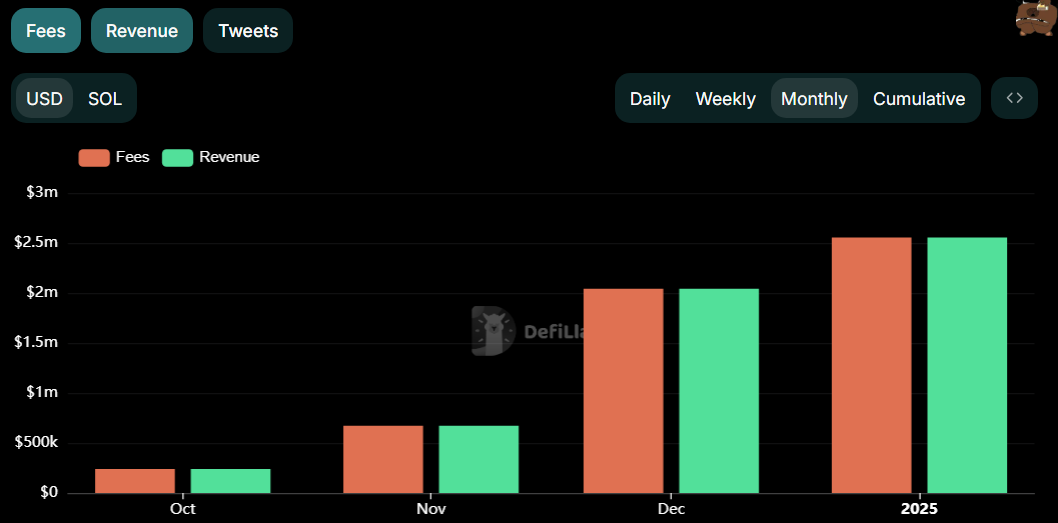

First, the project unveiled an initiative to support the development of AI client projects on the platform by providing sustainable rewards to ecosystem builders. These rewards are funded through post-thread taxes, which are fees the platform generates after the AI agents are up and running. see below.

With this initiative, Virtuals Protocol will likely aim to increase adoption of its ecosystem, which could attract interest and recognition from new investors. This in turn is expected to contribute to long-term growth and increase the potential value of its underlying utility and virtual governance token.

Secondly, the project has Announce A buyback and burn initiative, where approximately 13 million virtual tokens, accumulated from post-link trading revenue generated by several AI agent projects, will be used to burn the tokens of the respective agent over a period of 30 days. Token burning permanently removes these tokens from circulating supply, creating deflationary pressure that can increase their value.

Third, revenue generated by the Virtuals protocol has increased significantly over the past months, rising from $240.68K in October to over $2.5M by mid-January. This revenue growth typically indicates an increasing number of AI agents deployed on the platform and a greater volume of transactions between them, indicating a growing and thriving ecosystem – an attribute often viewed favorably by investors.

Other factors that may have contributed to VIRTUAL's rise include: Bitcoin's recent value exceeded $100,000 Risk sentiment is increasing in the market, as evidenced by the Cryptocurrency Fear and Greed Index moving into the “Greed” zone.

VIRTUAL's rise also coincided with a broader rebound in cryptocurrencies linked to AI agents, which rose 12.7% over the past day, in part. Performance driven From LUNA and AIXBT – two tokens from two popular AI projects deployed on the virtual protocol – which recorded gains of 24% and 27% respectively.

Hypothetical price action

On the 1-day VIRTUAL/USDT chart, the token's price remains above the 50-day moving average and the 100-day moving average, indicating that the bulls are starting to take control of the market. This is confirmed by the Relative Strength Index reading, which moved to 58.

Furthermore, the Average Trend Index showed a reading of 28. A reading above 25 indicates clear trend strength, which, in this case, reflects an increasing uptrend in the market.

Additionally, the Moving Average Convergence Divergence indicator shows that the MACD line (blue) is pointing upward as it is close to crossing above the signal line (orange), which will confirm a bullish reversal.

Given these technical signals, VIRTUAL will likely retest its all-time high at $5.07. A break above this level could lead to price discovery, with the token potentially reaching $5.25, representing a 33% upside from its current price of $3.79.

However, if the MACD line fails to cross the signal line, this bullish scenario will be invalidated, which could send the altcoin falling towards the $2.50 psychological support level.

Source link