Disclaimer: The opinions expressed by our writers are their own and do not represent the opinions of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

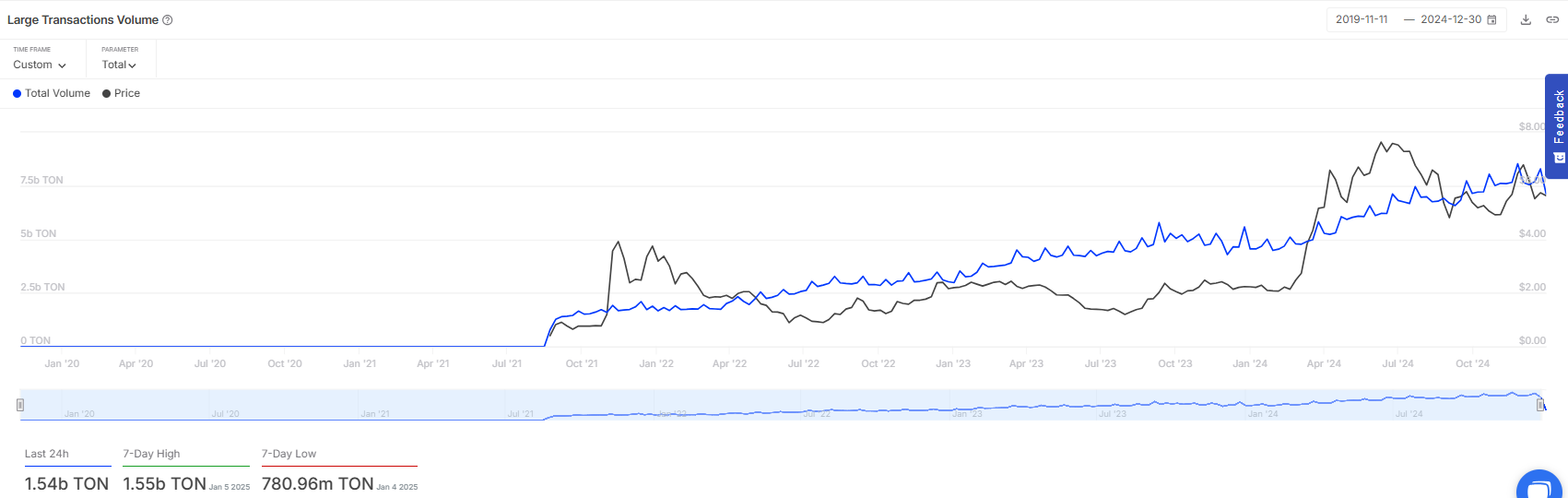

ton coin (ton) The volume of large transactions has increased significantly over the past 24 hours, indicating significant whale activity despite a $482 million market sell-off across the cryptocurrency sector. On-chain data shows an increase in TON transactions worth over $100,000, indicating that large holders are actively accumulating or reallocating their holdings.

The cryptocurrency market extended the sell-off from Tuesday's session to Thursday, with $482 million worth of crypto positions liquidated in the past 24 hours, according to CoinGlass data. The significant liquidations across various crypto assets reflect the selling pressure that has affected the majority of digital assets.

Bitcoin fell for the third day in a row, down 2.26% in the past 24 hours. Most other major coins also declined. Dogecoin fell 3.83%, while Cardano (ADA) fell 6.83%.

Amid this, Toncoin reflected a surge in large transaction volumes, which, according to IntoTheBlock The data, amounts to $8.21 billion, or 1.54 trillion tons in cryptocurrency terms, which represents a 94% increase in the 24-hour time frame. An increase in large transaction volume usually indicates an increase in whale activity, whether buying or selling.

At the time of writing, TON is showing initial signs of recovery, rising 0.09% over the past 24 hours and falling 7.49% in the past week.

Inflation fears are fueling the market sell-off

The cryptocurrency market extended the sell-off as investors studied the minutes of the Federal Reserve's December meeting released on Wednesday. Fed officials hinted during the meeting that the pace of interest rate cuts may slow this year, raising concerns about inflation.

“Almost all participants viewed upside risks to inflation expectations as having increased,” the meeting minutes said. “As reasons for this judgement, participants cited stronger-than-expected recent readings on inflation and the potential impacts of potential changes in trade and immigration policy.”

A slew of jobs data was released this week, and investors are eagerly awaiting Friday's non-farm payrolls report - one of the last important data to be revealed before the Fed's meeting at the end of January.

Source link