Cryptocurrencies are becoming increasingly integrated into the modern financial reality, and like any other asset, they are subject to taxation.

As a relatively new and rapidly growing asset class, cryptocurrencies are attracting increasing interest from investors and governments. As the global economy adapts to this digital innovation, countries are taking different approaches to regulating and taxing cryptocurrencies. how Cryptocurrency Tax policies work around the world?

Which countries require you to pay taxes on cryptocurrencies?

In the United States, it is simply impossible not to pay taxes – the authorities are very strict about this and impose a tax on almost everything, including digital assets.

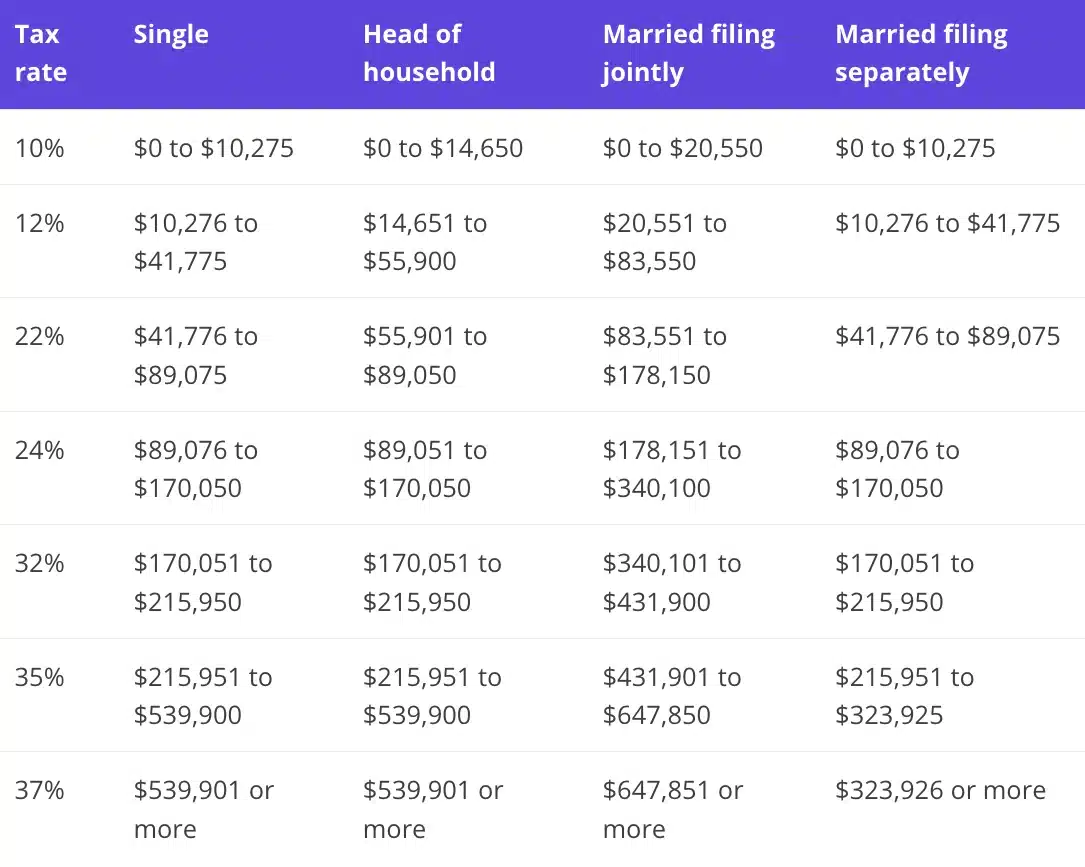

Cryptocurrencies are treated as property, not currency. This means that taxpayers must pay capital gains taxes when selling cryptocurrencies. The gain is subject to either short-term or long-term capital gains tax rates depending on how long the asset was held (less than one year or more).

in UKThe picture is much the same, as cryptocurrencies are taxed like other assets. Capital gains tax (CGT) applies to income above the tax threshold. If revenue from cryptocurrency trading exceeds a certain amount, taxpayers must file a tax return and pay tax.

The Australian Tax Office also classifies cryptocurrencies as assets. Investors must pay capital gains tax if they sell their tokens at a profit. However, there is a small clarification - in some cases, cryptocurrencies used to purchase goods and services may be exempt from tax if the transaction amount does not exceed $10,000.

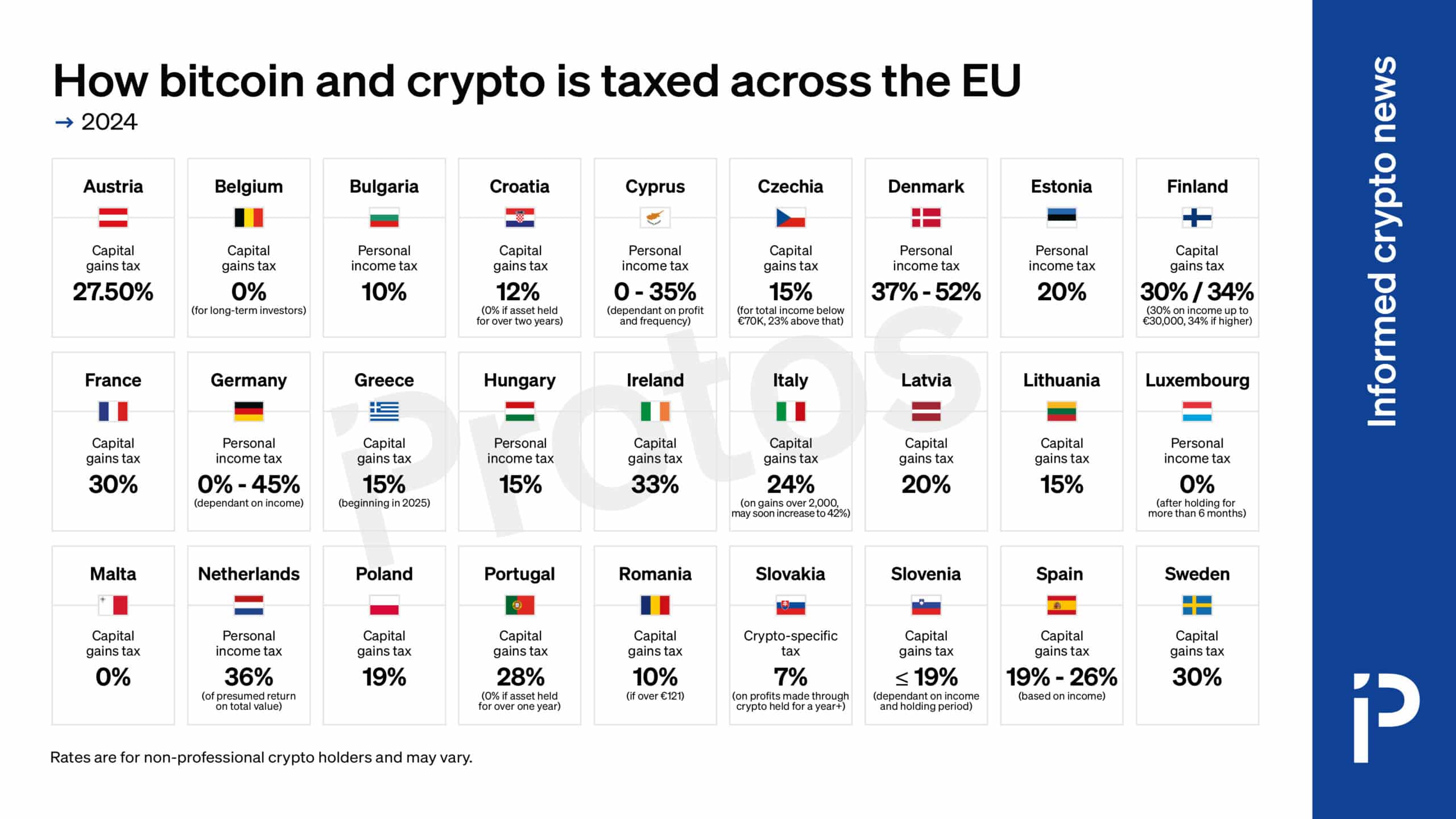

In general, Europe is the leader, with Switzerland Taking the plunge: Some residents of that country can not only pay for their purchases with cryptocurrencies, but can also pay taxes, according to the Federal Tax Administration (FTA). He explains:

“If salary or additional salary benefits are paid to an employee in the form of pay tokens, they are taxed as income from gainful employment 5 and must be shown on the salary certificate.”

Why don't some countries have to pay taxes on cryptocurrencies?

Many countries encourage the use of cryptocurrencies due to the lack of mandatory taxes - this is how the authorities are trying to attract investors and create startups in the field of cryptocurrencies.

Portugal has become one of the few countries where its citizens are exempt from paying taxes on the income they receive from cryptocurrencies commerce. There are exceptions when using cryptocurrency in professional or business activities.

in GermanyCryptocurrencies held for more than a year are not subject to taxes when sold. This creates an incentive for long-term investment in crypto assets. However, the profit will be subject to capital gains tax if the cryptocurrencies are sold before this period.

Malta It actively develops its own cryptocurrency industry and provides favorable tax conditions. Cryptocurrencies are only subject to tax if they are sold or exchanged Fiat currency; Otherwise, the tax is not applied.

However, there are countries where there is no need to pay taxes on cryptocurrencies just because they are banned.

Countries where cryptocurrencies are banned

China is one of the most famous countries that ban cryptocurrencies. All cryptocurrency transactions were banned in 2021, and regulators were cracking down on mining. This has created major problems for investors and cryptocurrency companies in the country.

In Algeria, the use of cryptocurrencies, including trading and Miningstrictly prohibited. The African country does not allow cryptocurrency transactions, including exchange and sale, making it impossible to conduct such transactions in the country.

Cryptocurrencies are also banned in many other countries, mostly in the Middle East, North Africa and Asia, such as Morocco, Pakistan and Pakistan. Indonesia.

Why don't some countries pay taxes on cryptocurrencies?

In addition to the ban and investment attractiveness, some countries do not pay taxes on cryptocurrencies for a straightforward reason: the authorities have not yet established regulations for digital assets.

For example, although Japan has recognized Bitcoin (Bitcoin) and other cryptocurrencies as a legal means of exchange, many aspects of their regulation are being developed. Although the country has many rules regulating cryptocurrency exchanges, there are many loopholes in legislation related to specific tax factors.

In Nepal, cryptocurrencies are still not clearly regulated, but are de facto banned. Since the government has not established legislation to regulate this class of assets, cryptocurrencies remain in a legal vacuum.

What's next for cryptocurrency taxes?

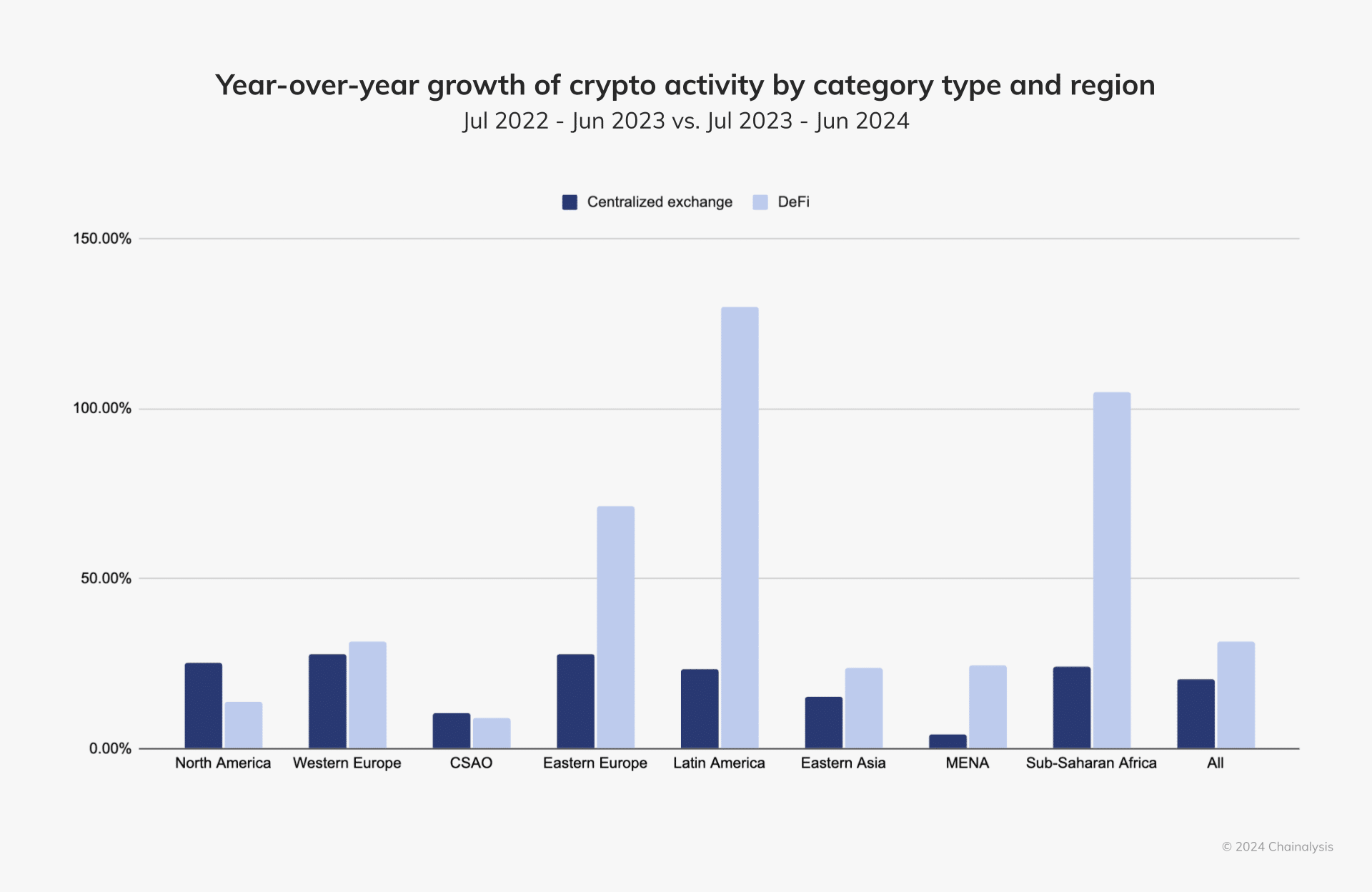

Taxes on cryptocurrencies vary from country to country, leading to different approaches to regulating and taxing these digital assets. While some countries are actively developing tax policies and regulations to deal with cryptocurrencies, others remain in a legal limbo, some banning their use altogether. However, according to Chaina Analysis, cryptocurrency adoption continues to grow globally.

Therefore, taxation of cryptocurrencies will likely continue to evolve towards greater clarity and regulation, providing stability to investors and market participants. However, changes may occur unevenly depending on the region and political environment.

Source link