Bitcoin is trading at over $96,000 on Tuesday, January 14. The largest cryptocurrency has recovered from a flash collapse below $90,000 and macroeconomic headwinds last week. Large-scale profit taking could push Bitcoin to support areas on the weekly chart, near the $70,000 level.

Bitcoin Market Drivers and Trump Effect

The inauguration of President-elect Donald Trump on January 20 is a major event that keeps traders' eyes peeled. Trump looms large over crypto, with his pro-crypto picks for SEC Chairman, AI & Czar, and prediction of pro-crypto regulation.

Bitcoin The price trend has become increasingly intertwined with macroeconomic movements in the US in the past few weeks. Bitcoin and cryptocurrencies represent one of the most easily illiquid risk assets, which influences their prices through macroeconomic updates.

Bitcoin started the day lower, opened above $94,000, covered lost ground, and reached a high of $97,371 in today's trading session.

The president-elect was clear about his expectations from the Federal Reserve and promised a strategic reserve of Bitcoin for cryptocurrency traders in the US, as crypto traders are concerned given that the central bank is independent and the next president will not play a role in decision-making.

The Bitcoin Act proposed by Senator Cynthia Lummis would create a strategic reserve of Bitcoin in the United States, and dollar-denominated debt would be used to purchase 1 million Bitcoins, or just under 5% of the total fully diluted supply of Bitcoin in the next five years.

Traders are monitoring the “Trump effect” on Bitcoin price direction as next week’s open approaches.

Bitcoin Analysts at 10X Research remain cautious ahead of Trump's term. Analysts note that market drivers are weak, and Bitcoin is likely to remain range-bound until mid-March.

Even as the post-election honeymoon phase for cryptocurrencies is over, the cryptocurrency industry that donated $238 million in the previous election cycle helped secure 298 pro-crypto lawmakers in Congress. It remains to be seen whether the relationship is reciprocal and can affect the price of Bitcoin in the long term.

Institutional appetite for Bitcoin is declining, and sentiment is deteriorating

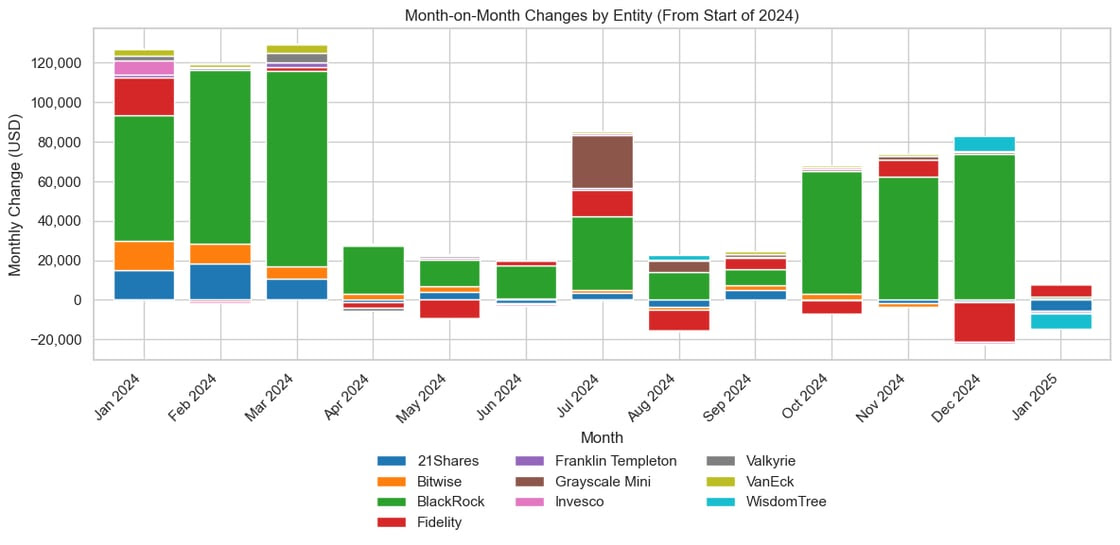

AmberData's research on Bitcoin ETF dynamics shows that institutions have significantly reduced their inflows into US Spot Bitcoin ETFs and are likely pausing new allocations amid the recent price decline. This move indicates risk-off behavior by institutional investors.

Bitcoin traders' warning in the short term will likely be followed by renewed conviction as BTC surges towards the $100,000 level. As Bitcoin price stabilizes above $95,000, this could make or break the next phase of inflows into spot Bitcoin ETFs.

Research suggests that continued inflows from major players such as BlackRock would signal a restoration of confidence, while continued outflows by 21Shares or Franklin Templeton could reinforce risk-off rhetoric. Traders should closely monitor ETF allocations to forecast Bitcoin price trends, to determine whether the asset will strengthen or test new levels in the coming weeks.

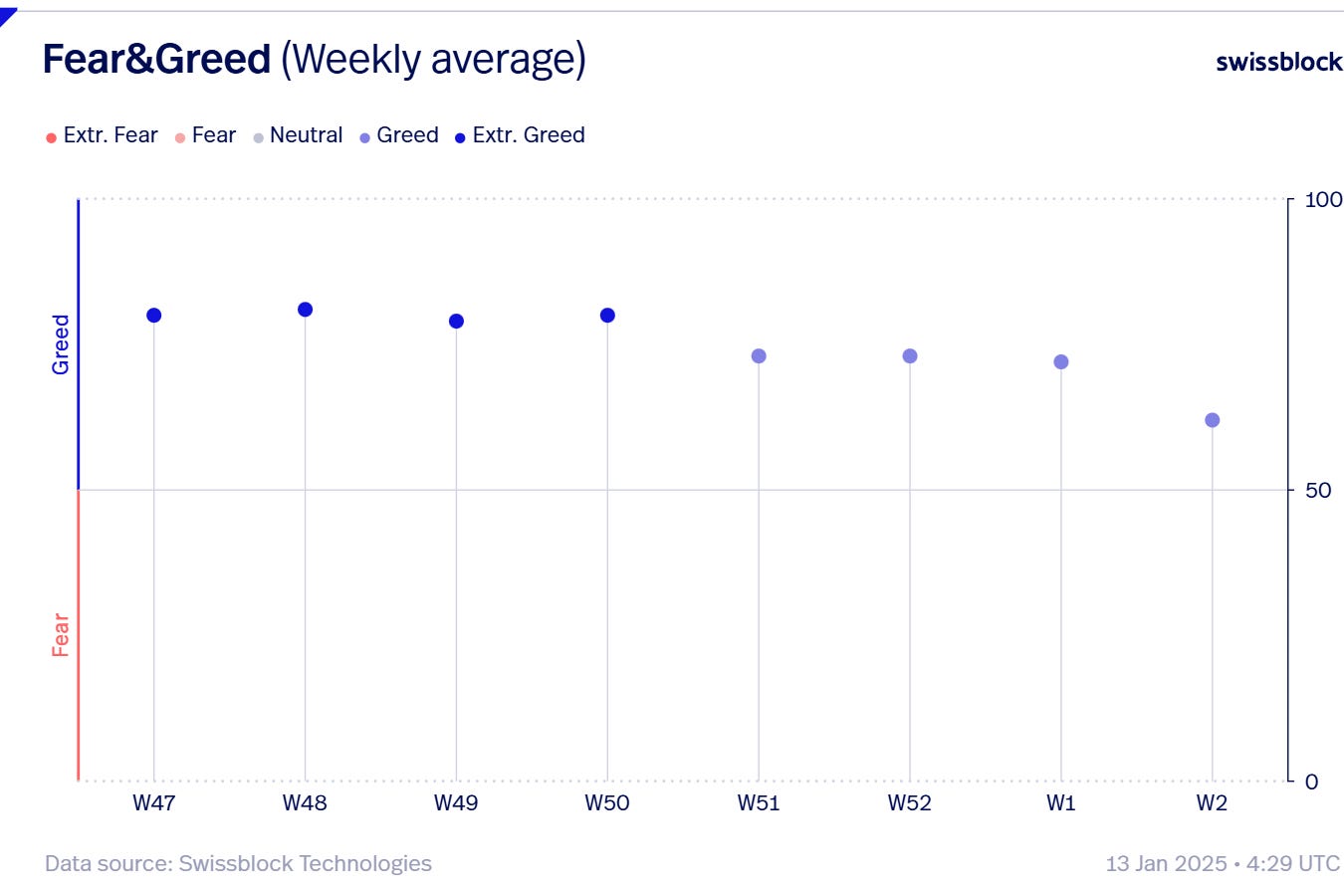

Data from Swissblock Insights shows Bitcoin sentiment deteriorating in the first two weeks of January. As Bitcoin fell to its lowest level of $90,000, this sparked caution among traders and led to a decline in the Fear and Greed Index.

Analysis of on-chain Bitcoin data and its derivatives

Coinglass data shows that open interest and options trading volume has increased over the past 24 hours. As derivatives traders position themselves for a sustained uptrend ahead of Trump's inauguration, sudden Bitcoin price movements could trigger a series of prolonged liquidations and leave traders exposed to a negative impact on their investment portfolio.

The current optimism among derivatives traders, evident from the buy-to-sell ratio (greater than 1) on exchanges like Binance and OKX, can be attributed to the expectation of a crypto-friendly Trump regime.

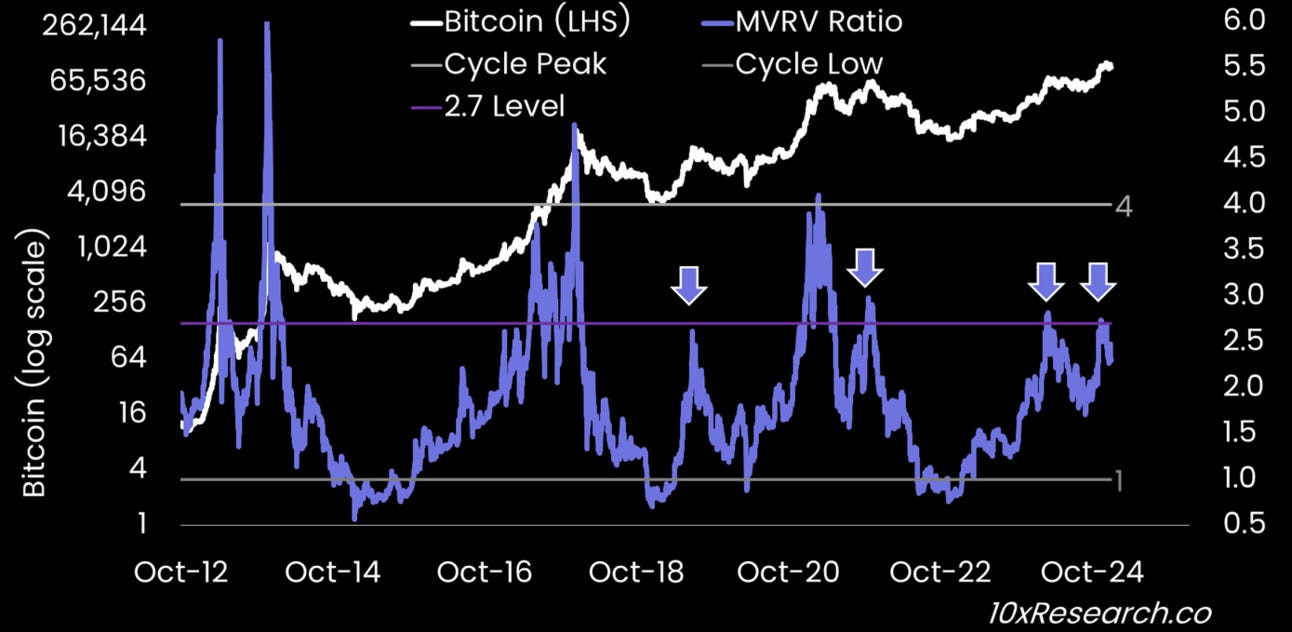

A chart of Bitcoin's log and market cap-to-cap ratio at 10X Research shows that the token is reaching levels historically associated with profit-taking by "smart money," meaning large portfolio investors and institutions. The MVRV ratio has reached 2.7x, and this usually leads to profit taking by BTC holders, as observed in previous cases.

Historically, when MVRV rises to 4x or 6x, it marks the beginning of a major correction in Bitcoin price.

When on-chain analysis is combined with the hawkish stance expected by the US central bank for several months, there is a strong possibility that the Bitcoin price will test support at $76,000 and perhaps $69,000, a dip below $70,000.

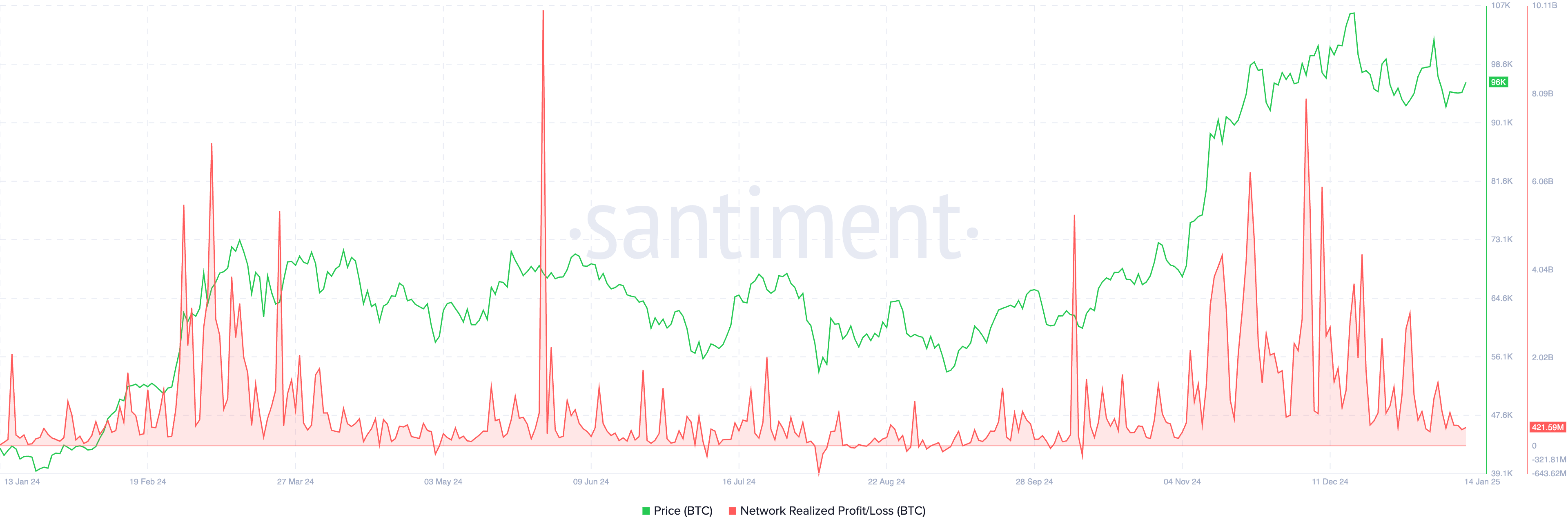

The network achieved the P/L metric on Santiment signals in agreement with the MVRV ratio and deteriorating sentiment among traders. Sustained spikes in profit taking over long periods of time are associated with Bitcoin price correction.

In a tweet on Alan considers $86,000 as a major support level and $76,000 as a minor support level.

If Bitcoin suffers a sharp correction and fails to bounce off the two support levels, it could fall below the $70,000 level.

Sergey Gorev, Head of Risk at YouHodler, told Crypto.news in an exclusive interview:

“Cryptocurrency prices are also showing negative dynamics against actively decreasing cryptocurrency trading volumes, as the direction of movement in the medium term is still unclear to traders. Everything is changing fast enough.

BTC prices have broken through the $92,000 resistance, which could also trigger a drop to $73,000, where there is currently strong support in the form of the 200 SMA.”

Matteo Boccini and the Crypto Finance team noted Bitcoin's rapid recovery from its drop below $90,000. The first major inflection point for a higher range is $96,800, and BTC holds above the support at $92,000.

Technical analysis and Bitcoin price forecast

Bitcoin is currently consolidating around the $96,600 level. The daily BTC/USDT price chart shows the formation of two imbalanced areas, or support levels, for Bitcoin. The first ranges from $81,500 to $85,072 and the second ranges from $76,900 to $80,216.

The $70,000 level is a major support for Bitcoin and will come into play once BTC fails to bounce from the two support areas and continues lower.

A 27% decline from the current price could push Bitcoin to test the $70,000 support level. This could erase all of Bitcoin's gains since November 5, 2024, meaning Bitcoin's post-election rally would be wiped out.

The Moving Average Convergence Divergence indicator shows red histogram bars below the neutral line, which means there is negative momentum behind the Bitcoin price trend. The RSI reads 51, near the neutral level of 50.

Disclosure: This article does not constitute investment advice. The content and materials contained on this page are for educational purposes only.

Source link